The concept of the velocity of money is a fundamental aspect of economics that helps us understand the rate at which money circulates in an economy. Let’s break it down for clarity:

Definition of Velocity of Money

The velocity of money refers to the frequency at which one unit of currency is used to purchase domestically-produced goods and services within a certain period. It is a measure of how fast money is exchanged from one transaction to another and how much economic activity is generated by a unit of currency in a specific time period.

Official Formula

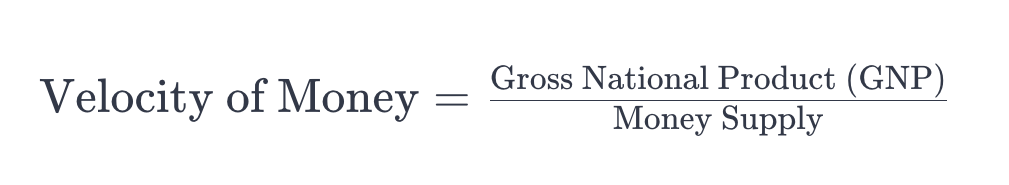

The most commonly used formula to calculate the velocity of money is:

Here, GNP refers to the total market value of all the goods and services produced by a country’s economy in a given year, and Money Supply is the total amount of monetary assets available in the economy at a particular time.

Importance of Measuring Velocity of Money

- Economic Activity Indicator: It helps in understanding the level of economic activity. High velocity indicates a high level of transactions and economic activity, suggesting a healthy, active economy.

- Inflation and Monetary Policy: It is crucial for central banks in formulating monetary policies. Changes in the velocity of money can lead to inflation or deflation.

- Economic Health Assessment: It can be a sign of the economic health of a country. A declining velocity might indicate a sluggish economy where money isn’t circulating efficiently.

Pros and Cons

Pros

- Insight into Economic Dynamics: It provides insight into how frequently money is circulating, which is vital for understanding economic dynamics.

- Policy Formulation: Assists policymakers in making decisions regarding interest rates, inflation, and economic growth.

Cons

- Oversimplification: It can oversimplify complex economic dynamics and may not always accurately reflect the health of an economy.

- Data Reliability: The accuracy of the velocity calculation depends on reliable and timely data, which is not always available.

Examples and Understanding

- High Velocity Example: In a bustling economy, where people frequently spend and invest, the velocity is high. Money quickly changes hands, driving business growth and consumer spending.

- Low Velocity Example: In a recession, people and businesses might hold onto their money due to uncertainty. This leads to lower spending and investment, slowing down the velocity.

Clarity in Understanding

Think of the velocity of money not in terms of physical speed but as a measure of economic efficiency and activity. It’s not about money moving at a certain speed, but rather how often it’s used in transactions that contribute to the economy.

It’s important to pay attention to it because it offers a snapshot of the economic vitality and helps in understanding whether an economy is thriving or struggling. It’s a bit like checking the pulse of an economy – too slow, and the economy might be stagnant; too fast, and it might be overheating.

In summary, the velocity of money is a vital economic indicator that helps us understand the rate at which money circulates in an economy, influencing economic health, inflation, and monetary policies. Understanding it offers insights into the overall economic activity and aids in strategic economic planning.

—

This page was last updated on February 24, 2024.

–