Money Transmitter License Law

Understanding US Money Transmitter Law is no easy feat. There are federal laws like:

- FinCEN

- Consumer Financial Protection Bureau (CFPB)

- Dodd-Frank Act

- US Department of Treasury

- Bank Secrecy Act (BSA)

- Patriot Act

- FISMA, etc.

Add to this, the money transmitter license laws for each state, as rolled out by the financial regulator of each US state and the experience of trying to understand it all, can be defeating.

The basic definition of an MSB (Money Services Business) can be seen on FinCEN’s website: Am I an MSB?

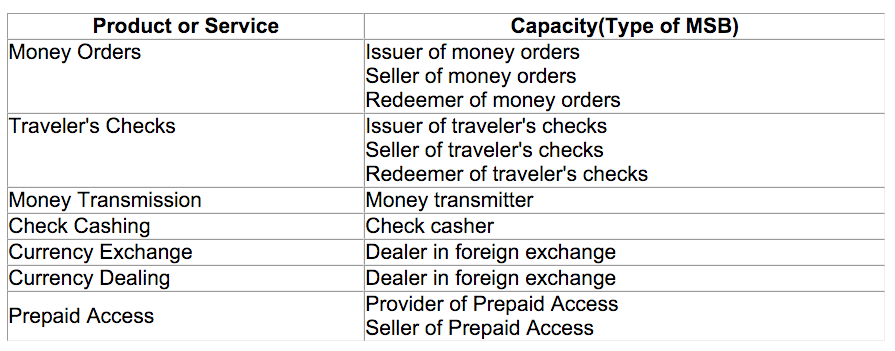

You could be classified as an MSB if you are engaged in:

One of the first aspects of understanding the money transmitter license law is if you are indeed what the federal government aptly titles you as an MSB (a Money Services Business).

The complete definition of an MSB is provided from the Code of Federal Regulations, Title 31 (Money and Finance: Treasury), Subtitle B, Chapter X, Part 1010 (General Provisions), Subpart A (General Definitions), §1010.100 (General definitions). Another great resource to access is the Cornell University Law School: Legal Information Institute.

Definition of a Money Services Business

Another aspect of the Money Transmitter License Law is to understand the definition of an MSB. The following is the definition of a Money Services Business (MSB) as provided by FinCEN

“Money Services Business – The term “money services business” includes any person doing business, whether or not on a regular basis or as an organized business concern, in one or more of the following capacities:

(1) Currency dealer or exchanger.

(2) Check casher.

(3) Issuer of traveler’s checks, money orders or stored value.

(4) Seller or redeemer of traveler’s checks, money orders or stored value.

(5) Money transmitter.

(6) U.S. Postal Service.

An activity threshold of greater than $1,000 per person per day in one or more transactions applies to the definitions of: currency dealer or exchanger; check casher; issuer of traveler’s checks, money orders or stored value; and seller or redeemer of travelers’ checks, money orders or stored value. The threshold applies separately to each activity — if the threshold is not met for the specific activity, the person engaged in that activity is not an MSB on the basis of that activity.

No activity threshold applies to the definition of money transmitter. Thus, a person who engages as a business in the transfer of funds is an MSB as a money transmitter, regardless of the amount of money transmission activity.

Notwithstanding the previous discussion, the term “money services business” does not include:

A bank, as that term is defined in 31 CFR 1010.100(d) (formerly 31 CFR 103.11(c)), or

A person registered with, and regulated or examined by, the Securities and Exchange Commission or the Commodity Futures Trading Commission.

For the complete regulatory definition of “money services business”, see 31 CFR 1010.100(ff) (formerly 31 CFR 103.11(uu)).

Note: Each money services business (MSB) is a financial institution. For the regulatory definition of “financial institution,” see 31 CFR 1010.100(t) (formerly 31 CFR 103.11(n)).”

Source: FinCEN

Definition of a “Person” within the MSB definition:

The definition of a “Person” within the definition of an MSB (as provided by FinCEN) is as follows:

“Person – A “person” is an individual, a corporation, a partnership, a trust or estate, a joint stock company, an association, a syndicate, joint venture, or other unincorporated organization or group, an Indian Tribe (as that term is defined in the Indian Gaming Regulatory Act), and all entities cognizable as legal personalities.

31 CFR 1010.100(mm) (formerly 31 CFR 103.11 (z))”

Source: FinCEN

Definition of a “Financial Institution” within the MSB definition:

The definition of a “Financial Institution” within the definition of an MSB (as provided by FinCEN) is as follows:

“Financial Institution – A “financial institution” includes any person doing business in one or more of the following capacities:

(1) bank (except bank credit card systems);

(2) broker or dealer in securities;

(3) money services business;

(4) telegraph company;

(5) casino;

(6) card club;

(7) a person subject to supervision by any state or federal bank supervisory authority.

For the regulatory definition of “financial institution,” see 31 CFR 1010.100(t) (formerly 31 CFR 103.11(n)).”

Source: FinCEN

Definition of a Money Transmitter

The definitions of a money transmitter are doled out individually by each state’s financial regulator.

For example, for the State of Georgia, the definition of MSB is provided by their Department of Banking & Finance as follows:

“Generally, a money transmitter is a person or business entity that is authorized/licensed to transmit money.

As used in Georgia law, ‘Money transmission,’ ‘transmit money,’ or ‘transmission of money’ means engaging in the business of receiving money or monetary value for transmission or transmitting money or monetary value within the United States or to locations abroad by any and all means, including, but not limited to, an order, wire, facsimile, or electronic transfer. The term does not include closed-loop transactions.

If a person is receiving money for transmission on behalf of another person or persons, they will need to be licensed. If a person were sending money on their own behalf, they would not need to be licensed.

Money transmitters and sellers-issuers of payment instruments operating in Georgia should be licensed with the Department. There are certain entities, however, that are exempt from licensing requirements.

Those Exempt from Licensing Requirements:

A state or federally chartered bank, trust company, credit union, savings and loan association, or savings bank with deposits that are federally insured;

An authorized agent of a licensee;

The United States Postal Service;

A state or federal governmental department, agency, authority, or instrumentality and its authorized agents;

Any foreign bank that establishes a federal branch pursuant to the International Bank Act, 12 U.S.C. Section 3102; or

An individual employed by a licensee or any person exempted from the licensing requirements of this article when acting within the scope of employment and under the supervision of the licensee or exempted person as an employee and not as an independent contractor.”

Source: Department of Banking & Finance

The list of all the US Financial Regulators for all the US States and Territories is provided here, and you can then look up the definition of what constitutes as a money transmitter for which licensing is required.

Money Transmitter License Law for Foreign Entities

Money transmitter license law also applies to entities that operate outside the US. Better known as Foreign-Located Money Services Businesses, the ruling cites the following:

“An entity may now qualify as a money services business (MSB) under the Bank Secrecy Act (BSA) regulations based on its activities within the United States, even if none of its agents, agencies, branches or offices are physically located in the United States. The Final Rule arose in part from the recognition that the Internet and other technological advances make it increasingly possible for persons to offer MSB services in the United States from foreign locations. FinCEN seeks to ensure that the BSA rules apply to all persons engaging in covered activities within the United States, regardless of the person’s physical location.”

Source: Foreign Located Money Services Business

MSB Registration

One of the requirements of the money transmitter license law is to register with FinCEN. The registration is simply just that — registration. It does not grant you a license to start operating. Many businesses who are classified as MSB falsely assume that just registering with FinCEN for all the states as an MSB means that a money transmitter license has been granted to them. This is not the case.

MSB registration with FinCEN is a mandatory federal requirement. All MSBs have to register. The next step would be to apply for money transmitter licenses with the state-level financial regulators for all the states in which you plan to do business.

The FinCEN MSB Registration page can be found here. The legal obligation for each business that files for MSB registration is clearly explained on the page, specifically with what sort of periodic/non-periodic reporting needs to be filed.

If you would like us to evaluate your money transmitter license requirements and see how we can assist you in finding coverage for MTLs, please kindly fill in the application below. All information shared is treated confidentially.

To get help with a European EMI License, contact us below.

—

This page was last updated on June 1, 2023.

–