Any student of economics will tell you, that sooner or later, the Bretton Woods Agreement will come into their syllabus and what a difference it made to the world.

Established in 1944, the Bretton Woods Agreement remains to be one of the most historical achievements ever made through global cooperation and coordination. The agreement was establish to streamline the management of monetary & exchange rates. The agreement was reached in July of 1944 at the U.N. Monetary and Financial Conference that went down in New Hampshire’s Bretton Woods. The Bretton Woods Agreement pegged currencies to the cost of gold and made the U.S. dollar the standard global currency. The agreement remains one of the most important decisions ever made in the global financial history.

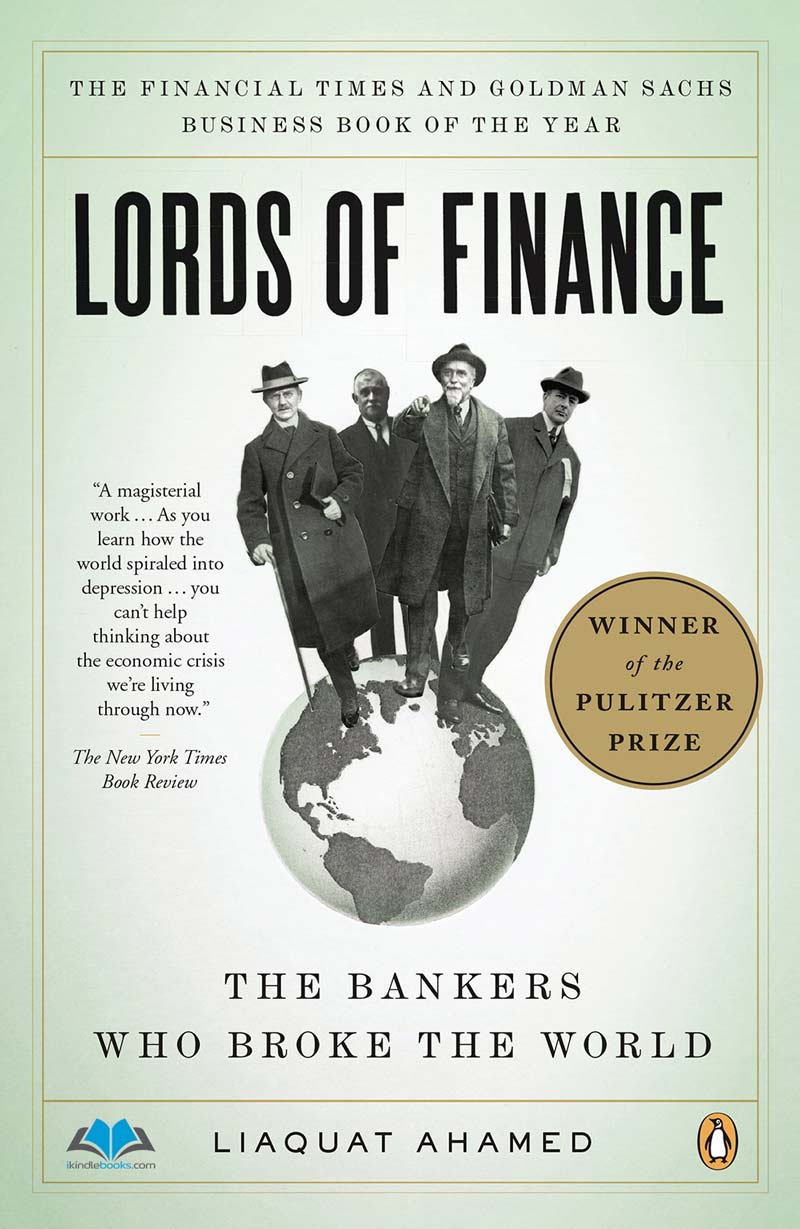

To get a better send of why the conference was held in the United States and why the world’s gold was mostly in the US, and why such a standard was needed, I cannot emphasis enough in reading a great book called Lords of Finance (The Banks Who Broke The World) by Liaquat Ahamed. Also important is to know, why the U.S. Dollar continued to be at the forefront on the stage of global currencies.

The creation of the Bretton Woods Agreement involved all the World War II Allied countries. 730 delegates from 44 countries met in Bretton Woods with the aim of creating a new and standard international monetary system. The primary objectives of the meeting was to improve economic growth, alleviate competitive devaluations and establish a system for foreign exchange rates. It took a period of more than 2 years just to prepare for the event.

United Kingdom’s John Maynard Keynes and the Treasury Department’s Harry Dexter White were the two key figures of the Bretton Wood System. The two were the primary designers of this system with Keynes proposing the creation of a global central bank that would be called Clearing Union and White proposing limiting the resources and powers of each country. Although both proposals were considered in developing the system, the Bretton Woods Agreement leaned more on the side of White’s proposal.

Every country that was involved in the creation of the agreement agreed to ensure that their central banks would have to preserve the fixed exchange rates between the standard currency (the dollar) and their own currencies. One of the strategies that these countries would implement to ensure this was purchasing its currency from the foreign exchange markets in the event that the value of their currencies dropped in relation to the dollar. This would as a result minimize the supply of the said currency and ultimately raise its value. For currencies that grew stronger, banks would print more to raise the supply and lower the value. I’ll also publish a separate article on Currency Debasement and also put some videos out.

Countries that participated in the event also came to an agreement aimed at preventing trade warfare. One way of achieving this was that the member countries agreed not to lower the value of their currencies with the aim of boosting trade. They were also required to regulate their currencies in some instances.

The Bretton Woods System was implemented and went fully operational in 1958. While it was taking effect, currencies were also becoming convertible. For currency conversion, nations were required to settle international balances strictly in dollars. The U.S dollars were on the other hand convertible to gold. At the time the system was just beginning to gain traction, the applied exchange rate was $35/ounce. The United States was charged with the duty of keeping fixed the prices of gold and appropriately adjusting the dollar supply.

Results of the Bretton Woods Agreement

The most notable outcome of the Bretton Woods Agreement was the creation of two bodies that would transform the international trade scene. The IMF – International Monetary Fund was among the bodies that were created following the agreement. IMF was very crucial to the success of the system. It was largely important since member countries would occasionally need to be bailed out if the value of their currencies dropped. The IMF would also monitor exchange rates to ensure that the standards were met.

Another institution created by the Bretton Woods Agreement was the World Bank Group. The main objective of the institution was to deliver financial assistance to countries to aid in reconstruction after the world war.

Dissolution of the Bretton Woods Agreement

The dissolution of the Bretton Woods System occurred between the years 1968 and 1973. The U.S. dollar was overvalued, a factor that led to the rise of concerns about the exchange rates and its tie to gold prices. The then president Richard Nixon instructed for a temporary suspension of the convertibility of the dollar – this is today called the Nixon Shock. This allowed countries to choose their own preferred exchange agreements.

The Bretton Woods Agreement contributed greatly to the development of the international economy and enhanced trade between countries. It also encouraged international cooperation and led to the creation of two institutions that have played a major role in the development of global economy.

—

This page was last updated on September 1, 2022.

–