The crypto epoch is upon us. Today, more and more financial institutions are starting to wake up to crypto, look at it, and stop dismissing it with a wave of their hand.

Very recently, Bank of Lithuania, which had a negative opinion on crypto has reversed its decision. Imagine a central bank of a country, reversing its viewpoint/opinion on crypto.

The revised opinion/article can be read here: Bank of Lithuania position on virtual assets and initial coin offering reflects changing market realities

The original opinion (PDF) circa 2014 can be accessed here: FAQ regarding Virtual Assets and Initial Coin Offering

It was no surprise that this week also, JPMorgan Chase also announced that it had started working on a stablecoin, i.e. an I.O.U. token for settlement amongst their member clients. The story was first broken by CNBC. You can read the article here: JP Morgan is rolling out the first US bank-backed cryptocurrency to transform payments business.

This is notedly in sharp contract to the earlier statement by their CEO Jamie Dimon who called bitcoin a “fraud”.

All this, needless to say, also started a huge debate on the interwebs about XRP’s demise as a bridge asset and why banks and businesses will most likely use the JPM Coin as a more asset backed, stable coin rather than use XRP.

One such debate can be read on #Reddit: JP Morgan Might Have Killed The XRP Dream. Another good article is one published by Forbes titled: The End of Ripple?

Needless to say, the infighting has already started. Each camp accusing the other of being amateur, the proverbial hair-pulling and hurling off abuses have started.

What trigged all this? The simple fact that for many, JPM Coin makes more sense than say XRP has a bridge asset. This has those folks holding a dwindling XRP, up in arms.

Suddenly the value proposition has changed. If JPMorgan Chase decides to do a fraction of their cross-border trade using JPM Coin, that number would be worth $10s if not $100s of Millions per day (if not a couple of Billions). Add to this mix, you have a coin, backed by a bank, whose value will not decline. That if you ‘own’ it and keep it, it does not lose its value (or gain) like the XRP. And if there is a crazy bear market run, and Bitcoin, Ethereum and XRP tanks, you are not affected by it, because you’re holding a “stablecoin”.

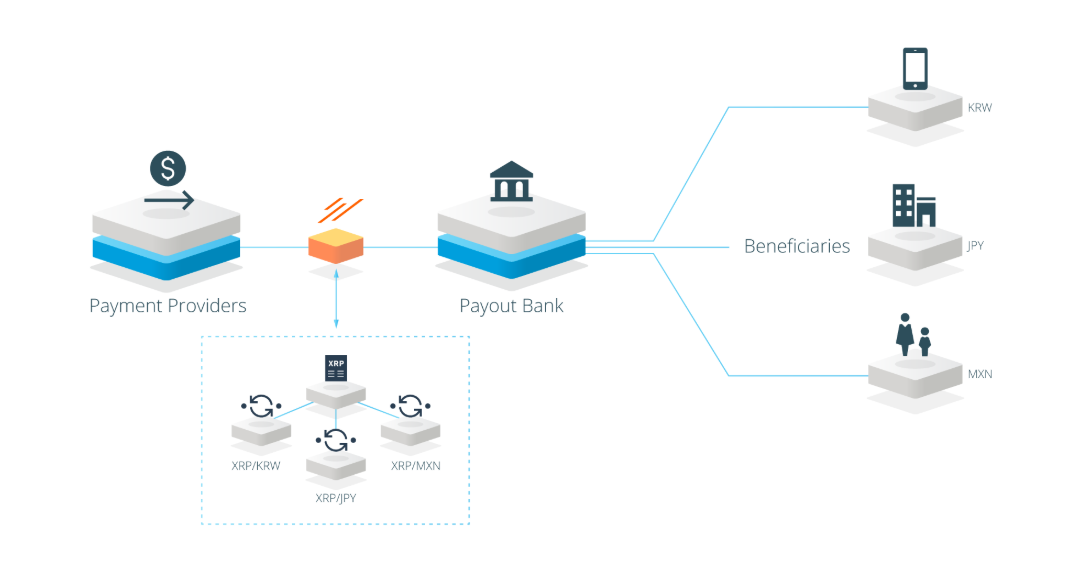

Pundits of XRP will be quick to point otherwise. Let’s run through an example. Let’s say two MSBs want to exchange money. One is denominated in United States Dollar and the other in Philippines Pesos. Let us assume someone wants to send $30,000 to Philippines.

The sending MSB will have to hit an exchange that provides USD/XRP pair. Once the XRP is purchases (minor cost of 0.1% to 0.25%), the money is sent to the receiving party, in Philippines. The receiving party will then sell the XRP for PHP using the PHP/XRP rate and obtain the Pesos equivalent.

If there is any delay in the PH party in selling the XRPs (it could be a holiday, or night time, etc.) then the XRP/PHP could possibly suffer an appreciation in price (which would be nice) or a depreciation in price, which would be bad.

So the receiving party needs to rid themselves of XRP at the very earliest.

If you are a liquidity provider for some exotic currency, then your whole business model is based on at what price you got your XRP at, and then at what price will they keep trading in the market. If you purchased your XRP as say 50 cents and the market drops to the current level of 30 cents, you’ve essentially lost out 40% value of your net XRP. This is bad news for any liquidity provider who holds on to the tokens.

If I have understood this wrongly, please comment on this post and clarify, I’d be curious to know what the argument for XRP would be in this case.

With the JPM Coin, the stage is being set for Wall Street Banks and their inevitable entry into the crypto world. I am pretty sure, plenty of other banks too are making their own stablecoin version and would be announcing themselves to the world soon.

It is exactly such announcements that make me recall an interview I did with Andy Bryant, COO of bitFlyer Europe where Andy touched upon the issue that once such Wall Street Banks and Institutional Investors enter the Crypto Main Street, they will need crypto exchange and the likes to manage their trades, security, infrastructure, etc.

The Interview with Andy Bryant, COO of bitFlyer can be heard here

Any which way you look at it, the big guns at Ripple will downplay this and say, ‘Told you so!’ nothing to worry about. Business as usual. In reality, the investors, HODLers and punters in XRP may not agree (only time will tell in a few weeks time).

Interesting times we live in, don’t you think so Mr. Dimon?

—

This page was last updated on September 1, 2022.

–