A Candid Take on Mercury Debit Card’s Country Restrictions

On February 9th, I landed in my inbox an update from Mercury that basically said, “Hey, your Mercury debit card comes with a ‘no-go’ list for certain countries.” This isn’t new; Mercury has always had a list of places where their cards were a no-fly zone. But, thanks to some recent tweaks in their system, they felt the need to remind us. Long story short, if you try buying something—online or face-to-face—in these off-limits countries, your card’s going to get a big fat “NOPE.”

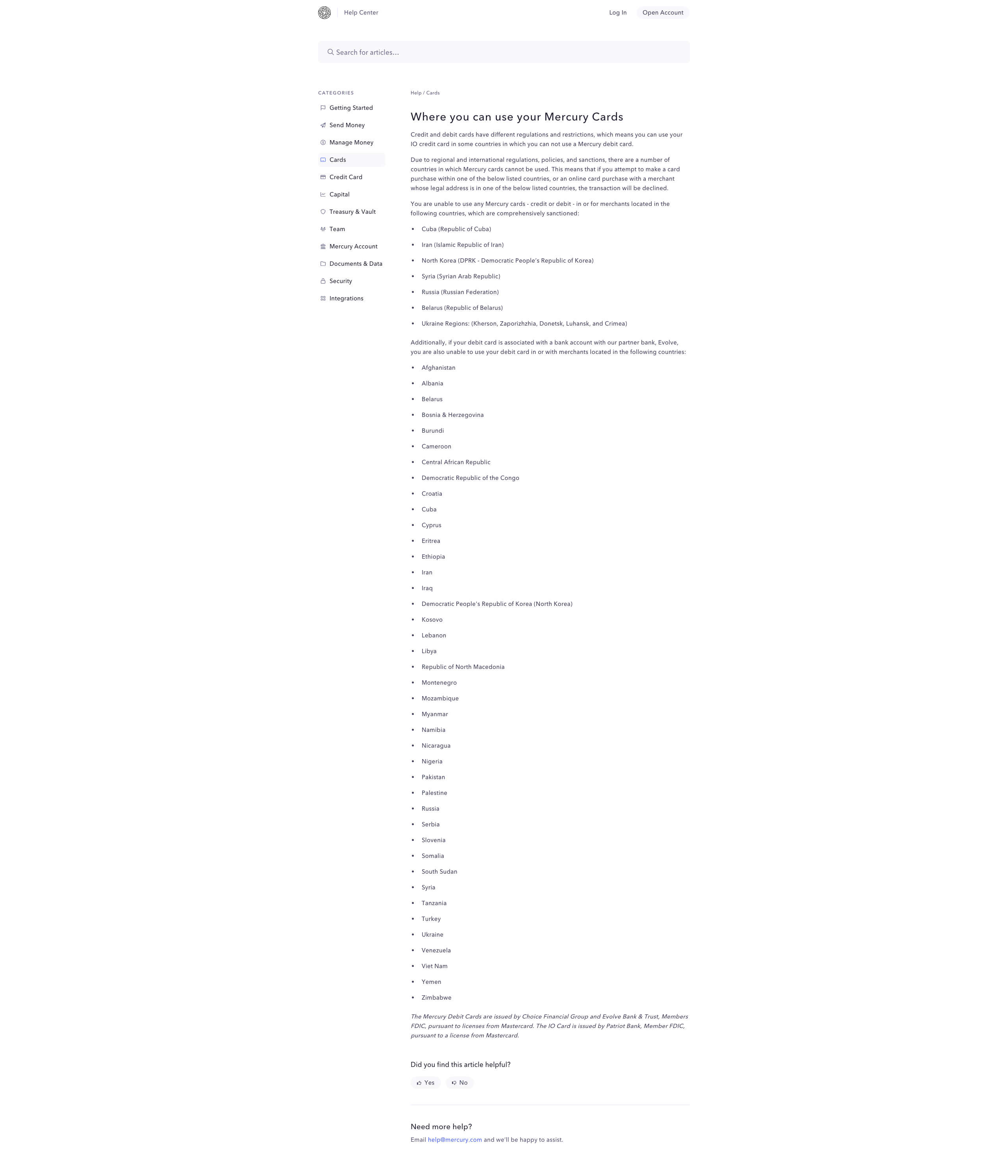

So, I did what any curious person would do: clicked through to see this infamous list. And there it was, a roll call of countries where my Mercury card is as good as Monopoly money. The reason? The usual spiel about credit and debit cards playing by different rules depending on where you are in the world. Basically, they’re saying, “It’s not us; it’s the regulations,” which felt like a bit of a cop-out to me.

The list includes the usual suspects: Cuba, Iran, North Korea, Syria, Russia, Belarus, Ukraine… you get the drift. But then, Mercury throws in a curveball. If your card is tied to a bank account in any of these places, their buddy, Evolve Bank, is also going to give you the cold shoulder (which is understandable)

And here’s where it gets even more head-scratching. They’ve tagged a whole bunch of countries as high-risk, which, to me, seems like they’re casting too wide a net. We’re talking about a lineup that spans from Afghanistan to Vietnam. Sure, some of these places have their issues, but lumping them all together felt a bit much.

For someone living in Turkey, like me, this felt especially jarring. The idea that a global card, backed by the might of the U.S., is being tripped up by these restrictions seemed off. And don’t even get me started on the FATF grey list. If you’re going to block countries, at least be consistent. Why leave out places like the United Arab Emirates or the Philippines, which are often mentioned in discussions about financial scrutiny?

This whole situation made me think. Mercury and Evolve need to take a step back and really look at what they’re doing. We’re in an age where digital banking should make our financial lives easier, not tie us up in red tape. These cards are supposed to work worldwide, tapping into the Visa or MasterCard networks without a hitch. So, this blanket approach to restrictions? It doesn’t just feel overly cautious; it feels downright out of touch.

In wrapping up, I can’t help but hope that Mercury and Evolve will rethink their stance. For the sake of their customers globetrotting or living in these so-called high-risk countries, it’s time to find a better balance. We need banking solutions that reflect the world’s complexity, not policies that paint with too broad a brush. After all, in today’s interconnected world, shouldn’t our financial tools be as borderless as our lives aim to be?

—

This page was last updated on February 12, 2024.

–