Nigeria’s Economic Turmoil and Cryptocurrency Clampdown

The Heart of the Crisis

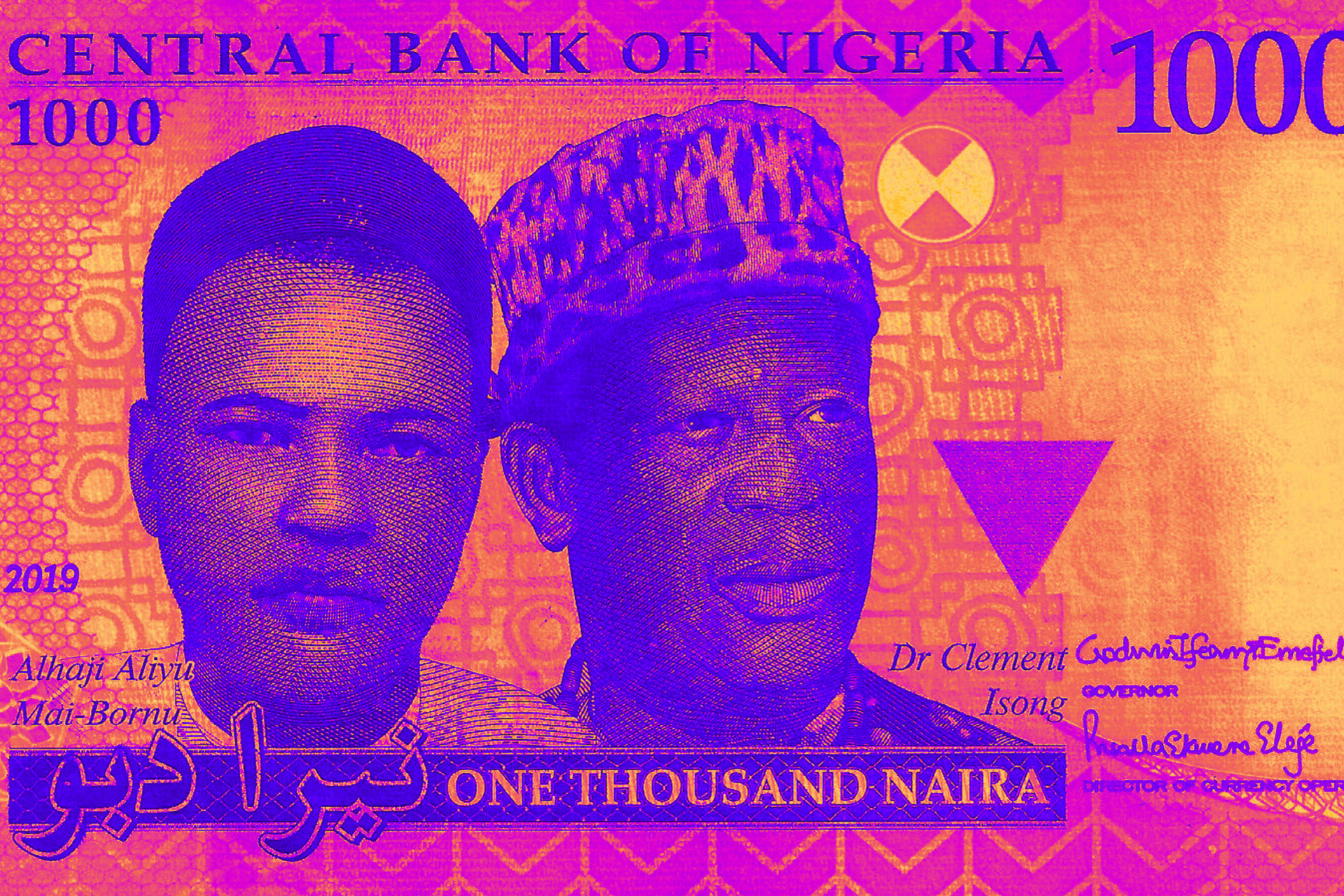

Nigeria is currently facing a significant economic challenge as its currency, the naira, experiences unprecedented depreciation. The situation has sparked widespread concern among citizens and financial analysts alike. At the core of this crisis is the government’s attempt to stabilize the naira by addressing what it perceives as illegitimate financial practices that undermine the national currency.

Government Intervention and Cryptocurrency

The Nigerian government has taken a bold stance against cryptocurrency exchanges, a move that is both controversial and indicative of the broader struggle to control financial speculation. By restricting access to major cryptocurrency platforms such as Binance, Coinbase, and Kraken, the government aims to eliminate what it views as a major contributor to the naira’s volatility. This decision, while temporary, reflects a desperate measure to curb the currency’s rapid decline.

However, these efforts have been met with skepticism. The naira’s brief appreciation following the crackdown was quickly reversed, with the currency setting a new record low by crossing the 2000 mark against the British Pound. This outcome underscores the complexity of the issue and the limited impact of government interventions on the currency’s value.

Cryptocurrency: A Double-Edged Sword

Regulatory Measures and Market Reaction

In an unprecedented move, the Nigerian Central Bank has implemented regulatory measures that cap the exchange rate on platforms like Binance, attempting to control the naira’s depreciation. Despite these efforts, the crackdown on Bureau de Change operators and the arrest of several individuals have not produced the desired effect on the currency’s stability.

The public’s reaction, as evidenced by a highly attended Twitter spaces discussion, highlights a collective defiance against these regulatory measures. The sentiment is clear: cryptocurrency, as a decentralized protocol, cannot be easily controlled or eliminated by governmental actions. This situation presents a dilemma for the Central Bank of Nigeria (CBN), which is caught between the need to stabilize the currency and the impracticality of suppressing a global financial movement.

The Role of Binance

Binance has been accused of manipulating the naira’s value, an allegation that speaks to the broader issue of cryptocurrency exchanges influencing national currencies. The platform’s temporary suppression of prices and the subsequent adjustment to resume trading activities have raised questions about the effectiveness and ethics of such interventions.

Economic Implications and Future Prospects

IMF’s Warning and the Path Ahead

The International Monetary Fund (IMF) has issued a stark warning about the potential for further depreciation and inflation, suggesting that Nigeria’s economic challenges are far from over. This warning, coupled with the naira’s continued volatility, paints a grim picture of the country’s financial future.

Despite these challenges, the resilience of the Nigerian people and their adaptability to new financial technologies suggest a possible pathway out of the crisis. Cryptocurrency, despite its controversies, offers an alternative to traditional financial systems that have consistently failed to protect the naira’s value.

Conclusion: The Uncertain Future of Nigeria’s Economy

The Nigerian government’s crackdown on cryptocurrency trading is a testament to the complexity of managing a national economy in the age of digital finance. While the central bank’s efforts are aimed at stabilizing the naira, the future remains uncertain. The events unfolding in Nigeria serve as a poignant reminder of the delicate balance between regulation and innovation in the quest for economic stability.

—

This page was last updated on February 23, 2024.

–