Definition and Origin:

Bonds, at their essence, are fixed-income instruments that represent a loan made by an investor to a borrower (typically corporate or governmental). Originating in the ancient times as a means for governments to raise money, the concept of bonds has evolved significantly. Initially, these were simple promises to repay borrowed sums. Over time, bonds have become sophisticated financial instruments, instrumental in funding public projects, corporate expansions, and government spending.

Usage Context and Evolution:

Bonds have traditionally been a cornerstone of the banking and financial industry, serving as a critical tool for capital raising and investment. Their usage spans across government treasuries, municipalities, corporations, and international entities. The evolution of bonds has seen them diversify into various types, including but not limited to, sovereign bonds, municipal bonds, corporate bonds, and more recently, green bonds and cryptocurrency-linked bonds. This evolution reflects shifting economic needs, investor preferences, and technological advancements.

Importance and Impact:

The importance of bonds in the financial sector cannot be overstated. They provide governments and corporations with a mechanism to finance projects and operations without raising taxes or diluting equity. For investors, bonds offer a predictable income stream and are a key component of a diversified investment portfolio. Bonds also play a critical role in determining interest rates across economies and thus have a profound impact on global financial markets.

Key Stakeholders and Users:

The primary stakeholders in the bond market include issuers (governments, municipalities, corporations), investors (individuals, institutional investors, banks, mutual funds), and intermediaries (investment banks, brokers). Each participant has a unique role, with issuers seeking to raise capital, investors looking for investment opportunities, and intermediaries facilitating transactions.

Application and Implementation:

The process of issuing bonds involves several steps, including credit rating assessment, pricing, underwriting, and distribution. The methodologies and technologies used in bond issuance and trading have evolved, with electronic trading platforms now facilitating a significant portion of bond transactions. Implementation challenges include regulatory compliance, market volatility, and interest rate risk management.

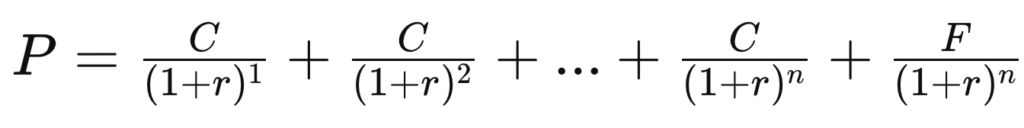

Formula (if applicable): The pricing of bonds is often determined by the formula:

where (P) is the price, (C) is the coupon payment, (r) is the yield or interest rate, (n) is the number of payments, and (F) is the face value.

Terminology and Variations:

Bonds are known by several names depending on the issuer, maturity, and interest payment characteristics, such as debentures, notes, bills, and securities. Each term carries nuances regarding the bond’s duration, security, and payment structure.

Ethical and Moral Considerations:

The bond market faces scrutiny over issues like funding environmentally detrimental projects, contributing to government debt sustainability problems, and the ethical implications of speculative trading practices. Green bonds and social bonds have emerged as responses to these concerns, focusing on funding environmentally friendly and socially beneficial projects.

Advantages and Disadvantages:

Bonds offer advantages like income stability, capital preservation, and portfolio diversification. However, they also pose risks such as interest rate sensitivity, credit risk, and liquidity issues. The balance between these factors depends on the bond’s characteristics and the market environment.

Real-World Applications and Case Studies:

Case studies include the U.S. Treasury bonds used to fund government spending, corporate bonds issued by companies like Apple for expansion, and green bonds funding sustainable projects worldwide. Each case illustrates the diverse applications and impact of bonds in financing global activities.

Future Outlook and Trends:

The bond market is poised for continued evolution, with trends like the integration of blockchain technology for bond issuance, the growth of green and sustainability-linked bonds, and the exploration of digital currencies by central banks. These developments promise to enhance transparency, efficiency, and accessibility in the bond market.

Analogies and Metaphors (Optional):

Bonds can be likened to the foundation of a building, providing structural support to the financial sector by facilitating stable investment avenues and funding essential projects across the globe.

Official Website and Authoritative Sources:

While there’s no single official website for the global bond market, authoritative sources include the websites of the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and the International Capital Market Association (ICMA).

Further Reading:

- Investopedia (investopedia.com) – For comprehensive definitions and explanations.

- The Economist (economist.com) – For analysis on global bond market trends.

- Bloomberg Markets and Finance (bloomberg.com/markets) – For up-to-date news and data on bond markets.

This analysis endeavors to provide a comprehensive overview of bonds within the global financial sector, highlighting their enduring significance, dynamic applications, and evolving trends.

—

This page was last updated on February 28, 2024.

–