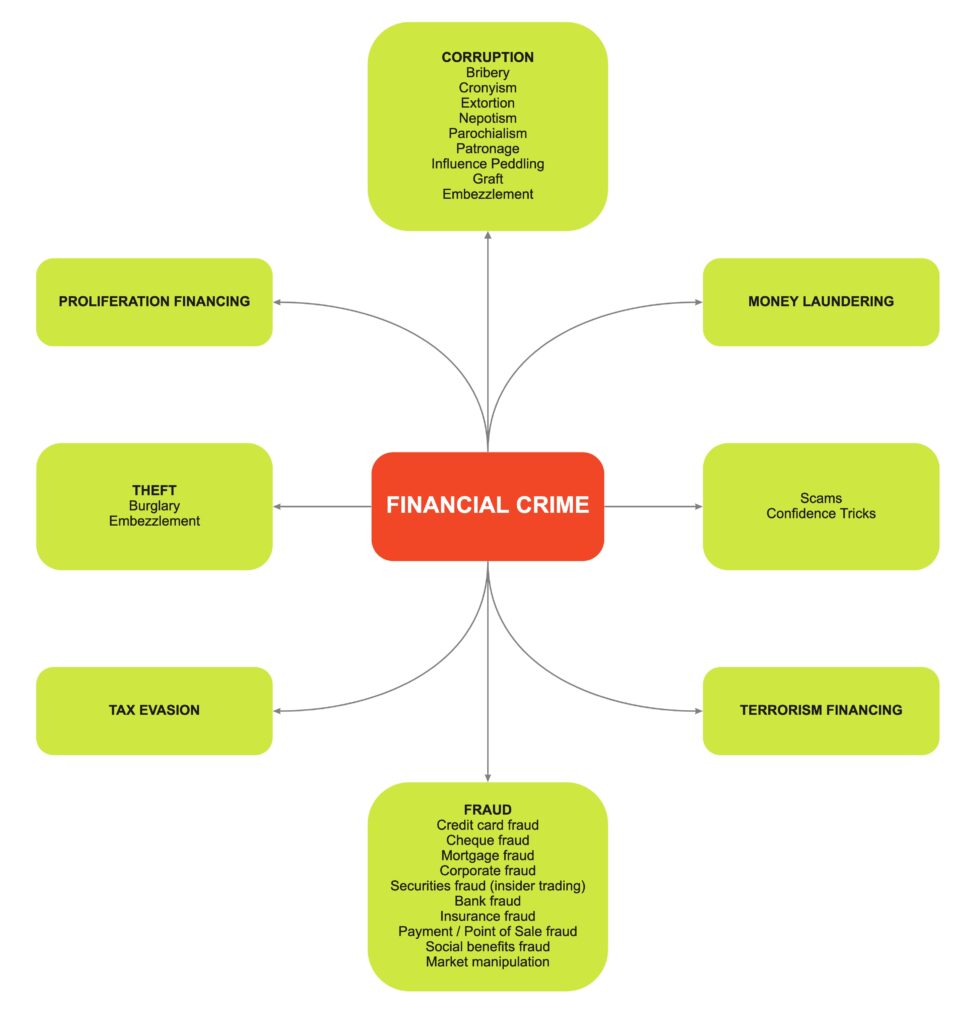

Financial crime refers to illegal activities that involve the use of money or financial systems to facilitate or conceal illegal activities. These crimes can include money laundering, fraud, insider trading, proliferation financing, terrorism financing, tax evasion, theft, and corruption.

Money laundering is the process of disguising the proceeds of illegal activities as legitimate funds. This is often done by moving money through a series of bank accounts or shell companies to make it difficult to trace the origin of the funds.

Fraud is the use of deception to gain financial or other benefits. This can include activities such as Ponzi schemes, securities fraud, and mortgage fraud.

Insider trading is the illegal practice of buying or selling securities based on non-public information. This is a serious violation of securities laws and can lead to significant financial losses for investors.

Proliferation financing is the use of financial systems to support the development of weapons of mass destruction. This can include activities such as providing funding to countries or organizations that are developing nuclear, chemical, or biological weapons.

Terrorism financing is the use of financial systems to support terrorist activities. This can include activities such as providing funding to terrorist organizations, or using charities as a front to raise funds for terrorist activities.

Tax evasion is the illegal practice of not reporting or underreporting income in order to avoid paying taxes. This can include activities such as not reporting all of your income, claiming false deductions, or hiding assets in offshore accounts.

Theft is the illegal taking of someone else’s property, including money and financial assets. This can include activities such as embezzlement, bank robbery, and identity theft.

Corruption is the use of power for personal gain. This can include activities such as bribery, extortion, and influence peddling.

Prevention and detection of financial crime is crucial in order to protect individuals, organizations, and the economy as a whole. This can include activities such as strengthening anti-money laundering regulations, increasing transparency in financial systems, and improving the ability of law enforcement agencies to detect and investigate financial crime.

In conclusion, financial crime is a serious problem that affects individuals, organizations, and the economy as a whole. It is important to be aware of the different types of financial crimes and to take steps to prevent and detect them. This can include strengthening regulations, increasing transparency, and improving the ability of law enforcement agencies to detect and investigate financial crime.

—

This page was last updated on January 13, 2024.

–