Definition and Origin

Treasury Bills, commonly referred to as T-Bills, are short-term government securities issued by the Treasury Department of a country to fund national debt and cover short-term expenses. Originating in the early 20th century, T-Bills were initially introduced to finance military expenditures during World War I. Over time, they have evolved into a key instrument for managing the liquidity in the financial system, allowing governments to stabilize their economies by controlling short-term interest rates.

Usage Context and Evolution

T-Bills are predominantly used in the banking and financial sector as a low-risk investment option and a critical tool for liquidity management. Banks, financial institutions, and individual investors buy T-Bills for their safety and reliability. The significance of T-Bills has shifted with the advent of monetary policy as a primary economic steering mechanism. Central banks now regularly use T-Bills in open market operations to regulate the money supply and influence interest rates.

Importance and Impact

The critical importance of T-Bills lies in their role as risk-free benchmarks for the financial markets. They offer a secure investment while providing governments with a flexible financing tool. The introduction of T-Bills has transformed the financial landscape by establishing a baseline interest rate (risk-free rate) against which other investments are measured. Their predictability and liquidity have made them a cornerstone in the portfolios of conservative investors and a key indicator for economic health.

Key Stakeholders and Users

The primary users of T-Bills include central banks, commercial banks, investment funds, and individual investors. Central banks purchase T-Bills to conduct monetary policy; commercial banks buy them for liquidity management and as a safe investment; investment funds include T-Bills in their portfolios for diversification and risk management; individual investors use T-Bills as a low-risk saving instrument.

Application and Implementation

T-Bills are issued through a competitive bidding process at auctions conducted by the Treasury or central bank. They are typically issued at a discount to face value, with the difference between the purchase price and the face value representing the interest earned by the investor. The implementation of T-Bill auctions requires a robust financial infrastructure to manage bids, issuance, and settlement processes efficiently.

Formula

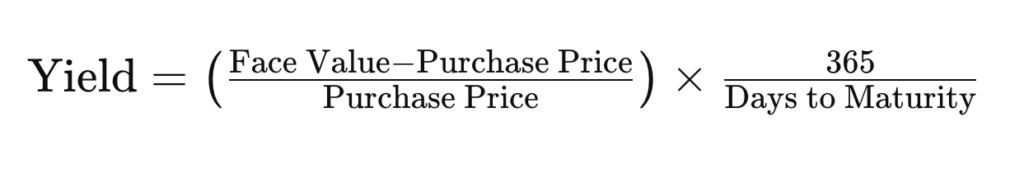

The yield of a T-Bill is calculated using the formula:

This formula helps investors understand the return on investment for T-Bills.

Terminology and Variations

T-Bills are also known as “Treasury notes” or “government bonds” in some contexts, though these terms can refer to longer-term securities. Variations include differing maturities, such as 1-month, 3-month, 6-month, and 1-year T-Bills, each serving slightly different investment and policy purposes.

Ethical and Moral Considerations

The issuance and trading of T-Bills are generally viewed as ethical, though concerns arise when governments excessively rely on debt to finance spending, potentially leading to unsustainable fiscal policies and economic instability.

Advantages and Disadvantages

Advantages:

- Low risk, as they are backed by the government.

- High liquidity, making them easy to buy and sell.

- Useful for portfolio diversification.

Disadvantages:

- Lower returns compared to riskier investments.

- Dependence on government fiscal health.

- Potential for negative real returns in high-inflation environments.

Real-World Applications and Case Studies

- Monetary Policy Management: Central banks use T-Bills to influence short-term interest rates and control the money supply, impacting overall economic activity.

- Investment Portfolios: Individuals and institutions incorporate T-Bills into their investment strategies to mitigate risk and ensure liquidity.

- Emergency Funding: Governments issue T-Bills to quickly raise funds during crises, such as natural disasters or economic downturns, demonstrating their utility in maintaining fiscal stability.

Future Outlook and Trends

The future of T-Bills involves digitalization and blockchain integration for issuance and trading, enhancing transparency and efficiency. Additionally, the role of T-Bills in green financing and social bonds is expanding, reflecting broader economic and environmental trends.

Analogies and Metaphors

Think of T-Bills as the financial world’s equivalent of a safety deposit box. Just as valuables are stored securely with minimal risk, investors use T-Bills to safeguard their capital, earning a modest return with very low risk.

Official Website and Authoritative Sources

For authoritative information on T-Bills, visit the websites of national treasury departments, such as the U.S. Treasury (www.treasury.gov) for U.S. T-Bills, or the respective financial authority of the country in question.

Further Reading

- Investopedia: Provides detailed articles on T-Bills and their role in the financial markets.

- The Financial Times: Offers analysis on the impact of T-Bill yields on global financial markets.

- Bloomberg: A source for real-time data on T-Bills and market trends.

This comprehensive overview of Treasury Bills within the global banking and financial services sector highlights their foundational role in modern finance, offering insights into their operation, impact, and future evolution.

—

This page was last updated on February 28, 2024.

–