A Step-by-Step Guide

In the rapidly evolving world of international remittances, businesses constantly seek to broaden their service reach. This endeavor often leads to questions about the process of incorporating additional payout countries. Whether your operations currently focus on a single country, such as the Philippines, Mexico, or Nigeria, and you’re looking to expand, understanding the necessary steps and considerations is essential. This guide provides a clear pathway for businesses aiming to extend their remittance services to new countries.

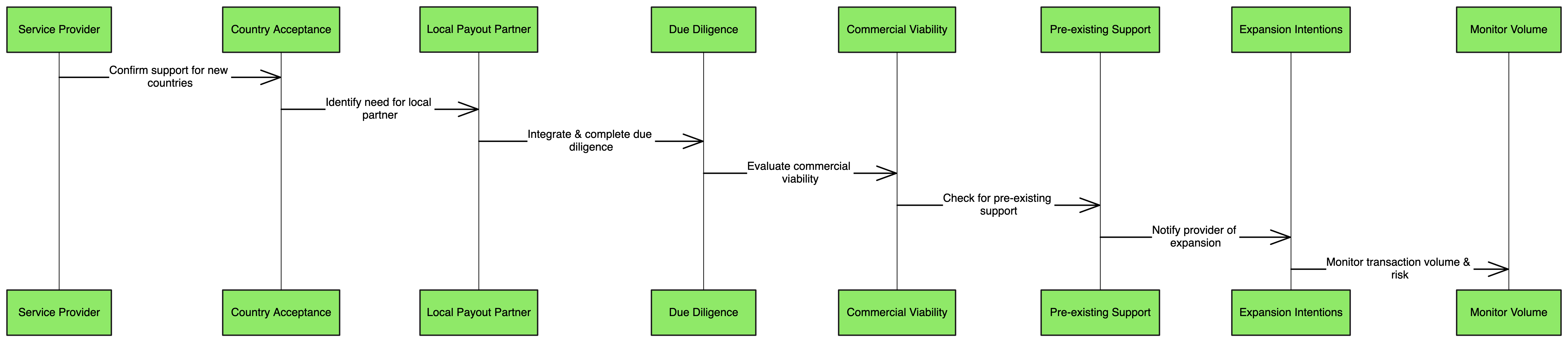

Step 1: Confirm Support with Your Sponsoring Bank or Program Manager

The first and most crucial step is to verify whether your existing sponsoring bank or program manager can accommodate remittances to the new countries you wish to target.

Providers may have restrictions based on various factors, including risk assessments, strategic priorities, and transaction volumes to certain destinations. For instance, they might deem a country too high-risk or incompatible with their services roadmap. In cases where transaction volumes are anticipated to be low, they may require a compelling business case to proceed.

Step 2: Identify and Integrate with a Local Payout Partner

Should your existing provider be open to transactions in your target country yet lack a local partner for payouts, your subsequent action is to secure an appropriate local payout partner within that country. This stage entails finalizing agreements, merging systems, and performing comprehensive due diligence to guarantee both compliance and dependability. The decision of your sponsoring bank or program manager to collaborate with a new payout partner predominantly depends on the economic feasibility of incorporating the new country into their services.

Considerations for Expansion

Several critical factors influence the decision and process of expanding remittance services to new countries:

- Support from Service Providers: Verify that your provider is willing and able to support transactions in the new country.

- Risk Categorization: Understand the risk profile of the country to ensure it falls within acceptable limits set by your provider.

- Transaction Volume: Ensure there is enough demand and transaction volume to justify the expansion. Providers are more likely to support countries where there is a substantial business opportunity.

- Existing Support: Sometimes, the provider may already support your targeted country, significantly simplifying the process. It’s essential to check this beforehand to avoid unnecessary steps.

Costs and Ease of Expansion

While expanding remittance services, consider the potential costs associated with integrating new countries. These costs can vary depending on the provider and the complexity of the expansion. However, many service providers strive to make this process as seamless as possible, often involving minimal costs, especially if the country is already within their network.

Summary

Expanding your remittance services to include new countries is a strategic move that can open up new markets and opportunities. By following a structured approach—starting with confirming support from your sponsoring bank or program manager, identifying a local payout partner, and considering key factors such as risk categorization and transaction volume—you can effectively navigate the complexities of international remittance expansion. Always ensure to check whether the service provider already supports your targeted country, as this can greatly streamline the process. With the right planning and partnerships, extending your remittance reach can be a smooth and rewarding venture.

—

This page was last updated on February 7, 2024.

–