Understanding the Flow of Funds

It is extremely important in the banking & payments world, to understand the Flow of Funds (FoF). You may understand your business well, but someone listening to you for the first time may not. Many questions might go through a person’s mind when you explain your transaction and transaction flows. A similar analogy is like explaining the route you will take for a trip to someone very quickly and verbally. It would not be easy to comprehend. So, let’s understand with a couple of videos, and diagrams.

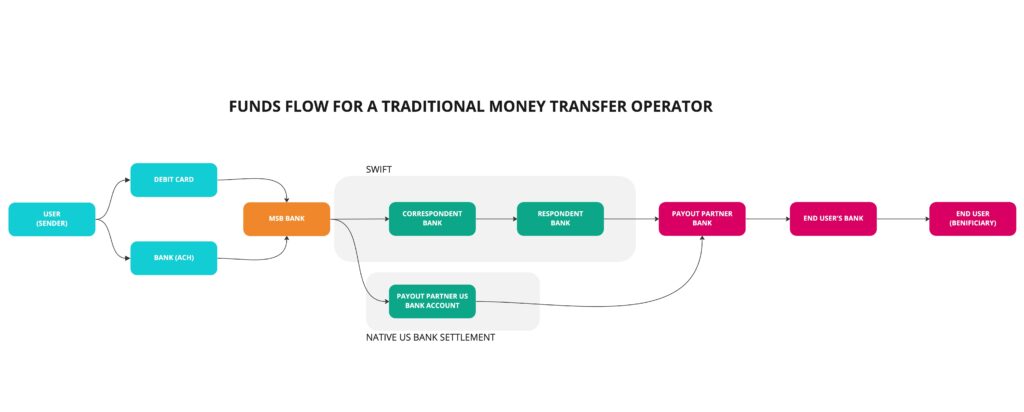

A flow of funds can best be thought of as a map. It shows the origination point, from where the money started its journey, and then the route it took along the way to reach its final destination, the termination point. In between all the roads and highways the money took, the pitstops, etc. are all explained in a flow of funds.

By looking at a FoF, can immediately get a sense of direction and get your bearing straight with respect to the law of the land and the regulations that govern it.

For any financial institution to better understand your business and business model, the funds flow diagram is extremely crucial. The diagram in many ways is a time-motion diagram depicting the flow of funds from the start of a transaction till its logical end.

It provides a unified, clear-cut blueprint on your transaction set and how the funds will be flowing in your proposed setup.

A properly constructed flow of funds diagram would identify various elements of a transaction, such as:

- Originator / Originating Institution

- Terminating Institution

- All intermediaries involved in the transaction

- Ownership of funds

- Fees and splits

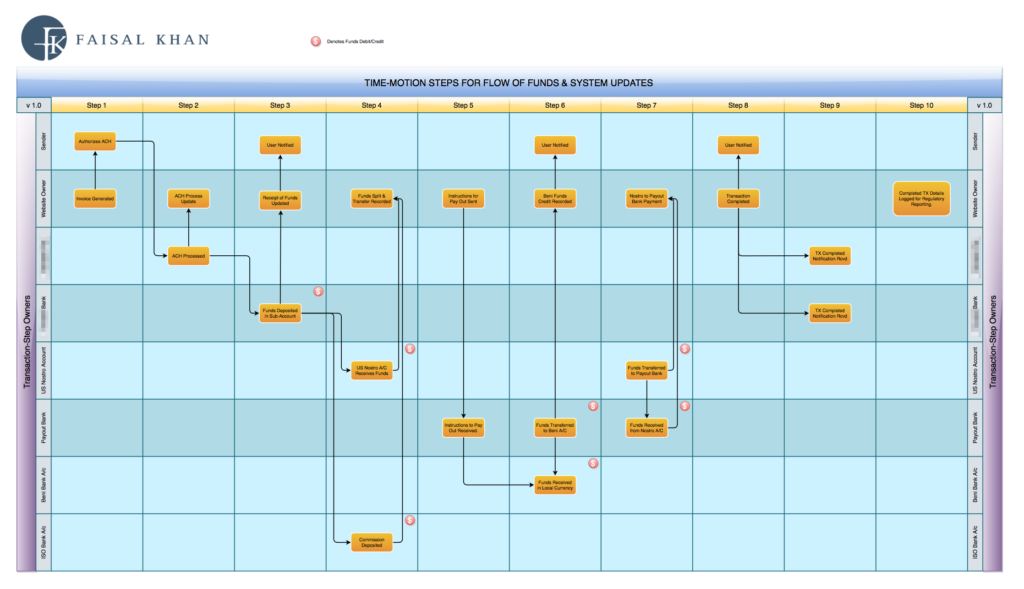

Sample Flow of Funds Diagram

Here is a sample time-motion flow of funds diagram. This just serves as an example as to how a funds flow diagram should look like:

The editable version of this file can be downloaded from here. Please use Draw.io (a free online editor) to upload this file and then work on it. Feel free to use this, without any citation and/or credit.

Here is another diagram for Funds Flow for Bitcoin remittances.

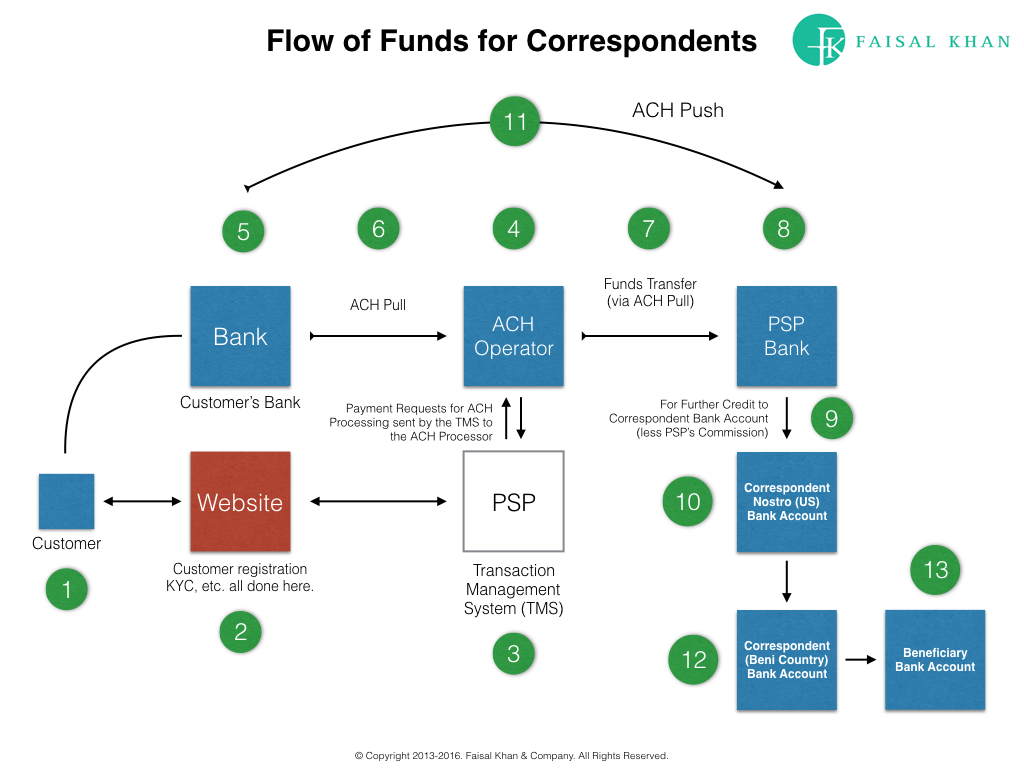

Here is another example:

You can download a copy of this flow of funds (including the descriptor document in Apple Keynote from here): Flow of Funds for Correspondents Revised

What is Next?

In order to start processing forward, here is what I would like you to do.

As you have a deeper understanding of your product (and ‘assume’ we do not), explain your transaction(s) set and Flow of Funds to us.

A transaction set is a financial movement task (payment, processing, etc.) that can be performed on the system you are envisioning. For us (and in turn the solution provider to better understand how this all works, you need to explain it to us, no matter how right or wrong it is.

Legally, the transaction set and the flow of funds have to come from you, only then to be edited by us &/or the solution provider to make it fit into the regulatory mold of the solution provider in question.

Showcasing Your Flow of Funds

DO NOT RUB ANYTHING FROM THE WHITEBOARD.

- Take a white sheet of printer paper (use multiple papers if required) or use a whiteboard.

- Draw our rough circles (or boxes) depicting the various geographies you might be working with. Like 3 circles, one would be the US, and one could be the EU, and one could be Singapore. etc. You get a general idea.

- Next show the entities, for example, draw a stick man to depict a user in the EU or US. Draw a small house to depict a business, etc., and use arrows to explain from WHERE the transaction is originating, and TO WHOM the transaction is going to benefit (i.e. be terminated/credited to).

- Use some figures to show. For example, A customer (depicted as a stick man on the paper/board) in the US decides to send US$ 100 to a business (depicted as a house on the paper/board) in Singapore. And the business receives S$ XXX.00 and shows what happened, and how the transaction was transported (or settled across) if you want to provide us with such details.

- Any conversions, or any magic that you wish to perform, etc., should clearly be identified.

- At all times, try to show the flow of money and funds.

- Try to be as granular as you can be.

- Also, if you can, as many places as you can, tell us who (as in which entity) has possession of the funds. This is extremely critical.

- ANY TIME!!!! We mean at any time if YOU have control of customer funds, even for a second, mention that. This is also extremely critical.

- Do this for all of your transactions.

Create a Video for Your Flow of Funds

Now comes the best part.

Take your mobile phone out and start video recording. Now record the video while explaining what is happening on the paper (or on the whiteboard).

It’s okay if your hair is in a mess or if you have not shaved. We don’t care. All we care about is the video and you, explaining in your own voice, what is happening.

Once this is done. You can send the video via WhatsApp: +1 (307) 218-2215 (be sure to mention on the WhatsApp message who you are). Alternatively, you can email the WeTransfer service or a Google drive link. We will not accept files in any other manner.

Looking forward to your submission.

Contact us!

—

This page was last updated on January 29, 2024.

–