Discover the World of Money Transfer Business

Comprehensive YouTube Series for Aspiring Entrepreneurs

Are you thinking about starting a money transfer business? Whether you’re a visual learner or simply searching for an in-depth resource, our YouTube series is a treasure trove of information. Spanning over 175 videos, this series delves into the intricacies of the money transfer industry, covering both person-to-person (P2P) and business-to-business (B2B) cross-border transactions.

Each video is designed to clarify concepts and explain various aspects of the business, making it a perfect starting point for anyone looking to enter this field.

Click below to explore our YouTube playlist and start your journey towards establishing a successful money transfer business today!

Foreword

Welcome to the Ultimate Guide on How to Start a Money Transfer Business (2024 Edition)

Your Comprehensive Resource for Building a Successful Remittance Enterprise

Dear Reader,

You’ve just discovered the most thorough and insightful guide available for launching a successful money transfer business. This comprehensive guide is more than just a manual; it’s a deep dive into the world of remittances, tailored to assist anyone looking to establish a thriving business in this sector.

Be prepared for an extensive exploration, as this guide spans over 100 pages. We’ve chosen to present it as a single, continuously updated page on our website. This approach allows us to keep the content current, reflecting the ever-evolving nature of the money transfer industry.

You won’t find this guide in a downloadable format. Instead, it’s exclusively available on our website, ensuring you always have access to the most accurate and up-to-date information.

As you navigate through the guide, you’ll find an intricate network of cross-references and hyperlinks, each leading you deeper into the myriad aspects of starting and running a money transfer business. These links are designed to enhance your understanding and showcase the complex considerations necessary for a successful enterprise.

This guide is for everyone – whether you’re a beginner or a seasoned professional. It serves as an all-encompassing resource, a foundational ‘Money Transfer 101’, and an essential reference. You’ll find detailed explanations, actionable advice, and real-world examples, covering everything from the basics to advanced topics, industry trends, and best practices.

We’ve crafted this guide to be your companion throughout your journey, from initial planning and development to the day-to-day management and growth of your business.

Take your time to read, understand, and apply the knowledge shared here. Let this guide be your constant ally as you embark on building a prosperous and impactful remittance business.

We wish you the utmost success and look forward to seeing the positive impact your business will make globally.

Welcome to your go-to resource for mastering the art of starting a money transfer business in today’s digital landscape.

Best Regards,

Introduction: How to Start a Money Transfer Business

Starting a money transfer business can be a lucrative and rewarding venture. The money transfer industry is a growing market, driven by the increasing globalization of the economy and the growing number of people living and working abroad. Money transfer businesses provide an essential service, enabling people to send and receive money quickly and securely across borders.

However, starting a money transfer business is not without its challenges. Entrepreneurs must navigate a complex and ever-changing regulatory landscape, as well as compete with established players in the market. Additionally, the business model for a money transfer business can be capital-intensive, requiring significant investment in technology and infrastructure.

Despite these challenges, the potential rewards of starting a money transfer business are significant. Money transfer businesses can generate substantial revenue through transaction fees and exchange rate spreads. Additionally, money transfer businesses can build a loyal customer base by providing reliable, efficient, and cost-effective services.

In this guide, we will provide entrepreneurs with a comprehensive overview of how to start a money transfer business. We will discuss the key considerations that entrepreneurs must take into account when starting a money transfer business, including market research and analysis, legal and regulatory requirements, and operational considerations. By following the steps outlined in this guide, entrepreneurs can develop a successful and profitable money transfer business.

DEFINITION OF MONEY TRANSFER BUSINESS

A money transfer business is a financial service provider that facilitates the transfer of money from one location to another. Money transfer businesses can be either brick-and-mortar establishments or online platforms. The primary goal of a money transfer business is to provide a secure, reliable, and cost-effective way for people to transfer money across borders.

Money transfer businesses can offer different types of services, including bank transfers, wire transfers, cash transfers, and online transfers. Bank transfers involve transferring money between bank accounts, while wire transfers involve transferring money through a secure network. Cash transfers involve sending cash through a money transfer agent, while online transfers involve using a digital platform to transfer money.

Money transfer businesses can serve different types of customers, including individuals, businesses, and government agencies. These customers may need to transfer money for different reasons, such as paying bills, sending remittances to family and friends, or conducting business transactions.

Money transfer businesses can be lucrative for entrepreneurs who are looking to tap into a growing market. However, starting a money transfer business requires thorough research, planning, and compliance with regulatory requirements. Entrepreneurs should be aware of the risks and challenges involved in the industry, including intense competition, regulatory compliance, and market saturation.

In summary, a money transfer business is a financial service provider that enables people to transfer money across borders securely and efficiently. It plays a vital role in the global economy by facilitating international trade, enabling financial inclusion, and supporting economic development. Entrepreneurs who are looking to start a money transfer business should have a clear understanding of the industry, the target market, and the regulatory requirements to succeed in this competitive market.

IMPORTANCE OF MONEY TRANSFER BUSINESS

The money transfer business plays a crucial role in the global economy by enabling people to transfer money across borders quickly, securely, and cost-effectively. With the increasing globalization of businesses and individuals, the demand for money transfer services has been on the rise. In this chapter, we will discuss the importance of the money transfer business and how it contributes to economic development, financial inclusion, and international trade.

One of the main benefits of the money transfer business is that it enables financial inclusion by providing access to financial services to people who may not have access to traditional banking services. This is particularly important for people in developing countries, where a large proportion of the population is unbanked or underbanked. Money transfer businesses provide a convenient and accessible way for people to send and receive money, pay bills, and conduct financial transactions.

Money transfer businesses also play a crucial role in supporting international trade by facilitating the movement of money across borders. Businesses rely on money transfer services to pay suppliers, receive payments from customers, and manage their cash flow. By providing a secure and reliable way for businesses to transfer money internationally, money transfer businesses help to reduce the costs and risks associated with cross-border transactions.

Another important benefit of the money transfer business is that it supports economic development by enabling remittances. Remittances are a significant source of income for many developing countries, with billions of dollars being sent each year to families and friends living in other countries. Money transfer businesses provide a cost-effective and efficient way for people to send and receive remittances, which can help to support local economies and improve the standard of living for millions of people.

In summary, the money transfer business is an essential component of the global economy, enabling financial inclusion, supporting international trade, and promoting economic development. Entrepreneurs who are looking to start a money transfer business can take advantage of the growing demand for money transfer services and contribute to the development of local and international communities. However, it is important to understand the challenges and opportunities in the industry and develop a clear business plan that addresses the needs of the target market.

- According to the World Bank, global remittance flows were estimated to be $689 billion in 2018, with developing countries receiving $529 billion of that amount. Remittances are a significant source of income for many developing countries, with some countries receiving up to 40% of their GDP from remittances.

- The top five recipient countries of remittances in 2020, according to the World Bank, were India, China, Mexico, the Philippines, and Egypt.

- The top five remittance-sending countries in 2020, according to the World Bank, were the United States, Saudi Arabia, the United Arab Emirates, the United Kingdom, and Canada.

- The Money Transfer and Remittances industry is expected to reach $1,390.40 billion by 2028, growing at a CAGR of 6.3% from 2021 to 2028, according to a report by Allied Market Research.

- The Global Forum on Remittances, Investment, and Development (GFRID) is an international platform that brings together stakeholders from the public and private sectors to discuss issues related to remittances, investment, and development. GFRID is hosted by the International Fund for Agricultural Development (IFAD) and is supported by several other international organizations, including the World Bank and the United Nations Development Programme (UNDP).

- The World Bank is a global institution that provides financial and technical assistance to developing countries. The World Bank collects and publishes data on remittance flows, including information on remittance costs, volumes, and corridors.

- The International Association of Money Transfer Networks (IAMTN) is a trade association that represents the money transfer industry. IAMTN provides resources and support to its members, including data on industry trends and best practices.

- The Financial Action Task Force (FATF) is an intergovernmental body that develops and promotes policies to combat money laundering, terrorist financing, and other financial crimes. The FATF sets international standards for AML and KYC compliance, which are important for money transfer businesses to follow.

The B2B money transfer market refers to the transfer of funds between businesses or institutions, rather than individuals. This market is a significant part of the overall money transfer industry and plays a vital role in supporting international trade and commerce. According to a report by Zion Market Research, the global B2B money transfer market size was valued at $15.8 trillion in 2019 and is expected to reach $28.37 trillion by 2027, growing at a CAGR of 8.1% from 2020 to 2027.

The B2B money transfer market is composed of several different segments, including banks, non-banking financial institutions (NBFIs), and fintech companies. Banks have traditionally dominated the B2B money transfer market, but the rise of fintech companies has disrupted the industry and increased competition.

One of the main drivers of the B2B money transfer market is international trade, which requires businesses to make cross-border payments to suppliers, vendors, and other partners. The growth of e-commerce and globalization has increased the demand for B2B money transfer services, as businesses need to make payments to partners in different countries and currencies.

Another important factor driving the B2B money transfer market is the increasing adoption of digital technologies. Digital platforms enable businesses to make payments quickly, securely, and cost-effectively, and allow for greater transparency and control over transactions. Fintech companies have been at the forefront of this digital transformation, offering innovative solutions that streamline the B2B money transfer process and reduce costs.

In summary, the B2B money transfer market is a large and growing segment of the overall money transfer industry. The market is driven by international trade, the adoption of digital technologies, and the increasing competition from fintech companies. Entrepreneurs who are looking to start a money transfer business can take advantage of the opportunities in the B2B market by developing innovative solutions that address the needs of businesses and offer a competitive advantage.

The total addressable market (TAM) for cross-border payments refers to the potential revenue that can be generated from the transfer of funds between individuals and businesses in different countries. According to a report by McKinsey & Company, the TAM for cross-border payments was estimated to be $2.2 trillion in 2018, with the potential to grow to $2.7 trillion by 2023.

The cross-border payments market is dominated by several leading institutions, including banks, payment networks, and fintech companies. These institutions offer different types of services and solutions for cross-border payments, ranging from traditional wire transfers to digital platforms that enable instant and low-cost transfers.

Some of the leading institutions that dominate the cross-border payments market include:

- SWIFT: SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global network that enables banks to communicate and exchange financial information securely. SWIFT provides a range of services for cross-border payments, including messaging, compliance, and settlement.

- Visa: Visa is a global payment technology company that provides a range of services for cross-border payments, including card payments, digital payments, and remittances. Visa operates a global network that connects financial institutions and merchants in over 200 countries and territories.

- Mastercard: Mastercard is a global payment technology company that provides a range of services for cross-border payments, including card payments, digital payments, and remittances. Mastercard operates a global network that connects financial institutions and merchants in over 200 countries and territories.

- PayPal: PayPal is a global digital payments company that enables individuals and businesses to make and receive payments online. PayPal offers a range of services for cross-border payments, including digital wallets, payment processing, and remittances.

- TransferWise: TransferWise is a fintech company that provides a digital platform for cross-border payments. TransferWise offers low-cost and transparent pricing for international transfers and supports over 750 currency routes.

In summary, the total addressable market for cross-border payments is large and growing, with the potential to reach trillions of dollars in revenue. The market is dominated by several leading institutions, including banks, payment networks, and fintech companies, that offer a range of services and solutions for cross-border payments. Entrepreneurs who are looking to start a money transfer business can take advantage of the opportunities in the cross-border payments market by developing innovative solutions that address the needs of customers and offer a competitive advantage.

CHALLENGES AND OPPORTUNITIES IN THE INDUSTRY

The money transfer industry is a highly competitive and rapidly evolving market that presents both challenges and opportunities for entrepreneurs. In this chapter, we will discuss some of the main challenges and opportunities in the industry and how entrepreneurs can navigate them to succeed in the market.

Challenges in the Industry:

- Regulatory Compliance: The money transfer industry is highly regulated, and entrepreneurs need to comply with a range of laws and regulations to operate legally. Compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements is a critical challenge that requires significant resources and expertise.

- Intense Competition: The money transfer industry is highly competitive, with numerous established players and new entrants vying for market share. The competition can lead to price pressure, which can affect profitability.

- Technology and Infrastructure: Technology and infrastructure are essential components of the money transfer business. Entrepreneurs need to invest in technology that can enable them to offer secure, fast, and cost-effective services to customers. They also need to establish a robust infrastructure that can support their operations and ensure scalability.

- Customer Acquisition: Acquiring and retaining customers can be challenging, especially in a highly competitive market. Entrepreneurs need to develop effective marketing strategies and offer competitive pricing to attract and retain customers.

Opportunities in the Industry:

- Growing Demand: The demand for money transfer services is growing, driven by factors such as globalization, immigration, and international trade. This presents an opportunity for entrepreneurs to tap into a large and growing market.

- Digital Transformation: The digital transformation of the money transfer industry is creating opportunities for entrepreneurs to develop innovative solutions that can improve the customer experience and reduce costs. The use of mobile apps, online platforms, and blockchain technology is transforming the way money transfer services are offered and delivered.

- Financial Inclusion: Money transfer services play a critical role in enabling financial inclusion by providing access to financial services to people who may not have access to traditional banking services. Entrepreneurs can leverage this opportunity by developing solutions that cater to underserved markets.

- Partnerships and Collaboration: Collaboration and partnerships with other players in the industry can help entrepreneurs to overcome challenges and seize opportunities. Partnering with banks, payment networks, and fintech companies can provide access to resources, expertise, and technology that can help entrepreneurs to grow their business.

In summary, the money transfer industry presents both challenges and opportunities for entrepreneurs. To succeed in the market, entrepreneurs need to develop a clear understanding of the challenges and opportunities and develop strategies that can help them navigate them effectively. By addressing the challenges and leveraging the opportunities, entrepreneurs can build a successful money transfer business that meets the needs of their target market.

Market Research & Analysis

Before starting a money transfer business, entrepreneurs must conduct market research and analysis to identify the target market, understand customer needs and preferences, and analyze the competition. This information is critical to developing a successful business strategy and identifying the unique selling proposition (USP) that will differentiate the business from competitors.

Market research and analysis involves collecting and analyzing data from various sources, including industry reports, customer surveys, and competitor analysis. By analyzing this data, entrepreneurs can gain insights into the market size, growth potential, customer demographics, and competitive landscape. This information can then be used to develop a targeted marketing strategy, identify the unique benefits of the business, and develop a pricing strategy that is competitive in the market.

Market research and analysis is a continuous process that should be conducted on an ongoing basis. As the market evolves and customer preferences change, entrepreneurs must be able to adapt their business strategy to remain competitive. This requires a deep understanding of the market and the ability to quickly analyze and respond to changes.

In this section, we will discuss the importance of market research and analysis in starting a money transfer business, the steps involved in the process, and provide examples of how to apply the insights gained from market research and analysis to develop a successful business strategy.

❗ Several years ago, I authored an in-depth article titled “Architecting a Mobile Wallet That Customers Want.” This piece provides essential information for initiating research, with a particular emphasis on field research.

For those who are deeply interested in field research, I highly recommend reading the work of Jan Chipchase, a renowned expert in the field. His book, “The Field Study Handbook,” is an invaluable resource that should not be missed.

IDENTIFYING TARGET MARKET

One of the critical steps in starting a money transfer business is identifying the target market. The target market refers to the group of customers that the money transfer business intends to serve. Identifying the target market is essential as it helps entrepreneurs to develop strategies that cater to the specific needs and preferences of the customers. In this chapter, we will discuss the importance of identifying the target market and the steps involved in the process.

Importance of Identifying the Target Market:

Identifying the target market is essential for several reasons:

- Focusing Resources: By identifying the target market, entrepreneurs can focus their resources on serving the specific needs and preferences of the customers. This can help to improve the customer experience and increase customer loyalty.

- Developing Effective Marketing Strategies: Effective marketing strategies are critical to the success of a money transfer business. Identifying the target market can help entrepreneurs to develop marketing strategies that cater to the specific needs and preferences of the customers.

- Competitive Advantage: Identifying the target market can help entrepreneurs to develop a unique value proposition that differentiates them from the competition. This can help to create a competitive advantage and increase market share.

Steps to Identify the Target Market:

- Conduct Market Research: The first step in identifying the target market is to conduct market research. This involves gathering information about the customers, competitors, and market trends. Market research can be conducted using various methods, such as surveys, focus groups, and secondary research.

- Analyze Customer Needs and Preferences: Once the market research is completed, entrepreneurs need to analyze the data to identify the needs and preferences of the customers. This can help entrepreneurs to develop services and solutions that cater to the specific needs and preferences of the target market.

- Develop Customer Personas: Customer personas are fictional representations of the target customers. Customer personas can help entrepreneurs to visualize their target market and develop strategies that cater to their specific needs and preferences.

- Segment the Market: Market segmentation involves dividing the target market into smaller groups based on specific characteristics, such as age, income, and location. Segmentation can help entrepreneurs to develop targeted marketing strategies that cater to the specific needs and preferences of each segment.

- Test the Target Market: Once the target market is identified, entrepreneurs need to test their services and solutions with the target customers. Testing can help entrepreneurs to gather feedback and make necessary improvements to their services and solutions.

In summary, identifying the target market is a critical step in starting a money transfer business. It helps entrepreneurs to focus their resources, develop effective marketing strategies, and create a competitive advantage. By conducting market research, analyzing customer needs and preferences, developing customer personas, segmenting the market, and testing the target market, entrepreneurs can identify the target market and develop solutions that cater to their specific needs and preferences.

Demographic analysis

Demographic analysis is a critical component of identifying the target market for a money transfer business. Demographics refer to the statistical data that describes the characteristics of a population, such as age, gender, income, education, and occupation. In this section, we will discuss the importance of demographic analysis in identifying the target market and the steps involved in the process.

Importance of Demographic Analysis:

Demographic analysis is essential for several reasons:

- Identifying Customer Needs and Preferences: Demographic analysis helps entrepreneurs to understand the needs and preferences of the target customers. By analyzing the demographic characteristics of the target market, entrepreneurs can develop services and solutions that cater to their specific needs and preferences.

- Developing Marketing Strategies: Demographic analysis helps entrepreneurs to develop targeted marketing strategies that cater to the specific characteristics of the target market. By understanding the demographic characteristics of the target market, entrepreneurs can develop marketing messages and channels that are more likely to resonate with the target customers.

- Creating Customer Personas: Demographic analysis helps entrepreneurs to develop customer personas that represent the target customers. By developing customer personas, entrepreneurs can visualize the target market and develop strategies that cater to their specific needs and preferences.

Steps in Demographic Analysis:

- Define the Population: The first step in demographic analysis is to define the population that is being analyzed. The population can be defined based on various characteristics, such as age, gender, income, and location.

- Gather Data: The next step is to gather data on the demographic characteristics of the population. Data can be collected from various sources, such as government statistics, surveys, and secondary research.

- Analyze the Data: Once the data is collected, entrepreneurs need to analyze the data to identify the demographic characteristics of the target market. This can help entrepreneurs to understand the needs and preferences of the target customers and develop services and solutions that cater to their specific needs and preferences.

- Develop Customer Personas: Based on the demographic analysis, entrepreneurs can develop customer personas that represent the target customers. Customer personas can help entrepreneurs to visualize the target market and develop strategies that cater to their specific needs and preferences.

- Segment the Market: Based on the demographic characteristics of the target market, entrepreneurs can segment the market into smaller groups that share similar characteristics. Market segmentation can help entrepreneurs to develop targeted marketing strategies that cater to the specific needs and preferences of each segment.

In summary, demographic analysis is a critical component of identifying the target market for a money transfer business. It helps entrepreneurs to understand the needs and preferences of the target customers, develop marketing strategies, and create customer personas. By defining the population, gathering data, analyzing the data, developing customer personas, and segmenting the market, entrepreneurs can perform effective demographic analysis and identify the target market for their money transfer business.

Market segmentation

Market segmentation is the process of dividing the target market into smaller groups based on specific characteristics such as age, income, location, and behavior. Market segmentation is a critical component of identifying the target market for a money transfer business. In this section, we will discuss the importance of market segmentation and the steps involved in the process.

Importance of Market Segmentation:

Market segmentation is important for several reasons:

- Targeted Marketing: Market segmentation helps entrepreneurs to develop targeted marketing strategies that cater to the specific needs and preferences of each segment. This can help to improve the effectiveness of marketing campaigns and increase customer acquisition.

- Customized Products and Services: Market segmentation helps entrepreneurs to develop products and services that cater to the specific needs and preferences of each segment. This can help to improve the customer experience and increase customer loyalty.

- Competitive Advantage: Market segmentation can help entrepreneurs to create a competitive advantage by developing solutions that cater to the specific needs and preferences of each segment.

Steps in Market Segmentation:

- Define the Segments: The first step in market segmentation is to define the segments based on specific characteristics such as age, income, location, and behavior. The segments should be relevant to the money transfer business and the target market.

- Gather Data: The next step is to gather data on the characteristics of each segment. Data can be collected from various sources, such as surveys, secondary research, and customer feedback.

- Analyze the Data: Once the data is collected, entrepreneurs need to analyze the data to identify the needs and preferences of each segment. This can help entrepreneurs to develop solutions that cater to the specific needs and preferences of each segment.

- Develop Marketing Strategies: Based on the needs and preferences of each segment, entrepreneurs can develop marketing strategies that cater to the specific characteristics of each segment. This can help to improve the effectiveness of marketing campaigns and increase customer acquisition.

- Develop Products and Services: Based on the needs and preferences of each segment, entrepreneurs can develop products and services that cater to the specific characteristics of each segment. This can help to improve the customer experience and increase customer loyalty.

In summary, market segmentation is a critical component of identifying the target market for a money transfer business. It helps entrepreneurs to develop targeted marketing strategies, customized products and services, and create a competitive advantage. By defining the segments, gathering data, analyzing the data, developing marketing strategies, and developing products and services, entrepreneurs can perform effective market segmentation and identify the target market for their money transfer business.

ANALYZING THE COMPETITION

Analyzing the competition is a critical component of market research for a money transfer business. The competition refers to other businesses that offer similar services and solutions to the target market. Analyzing the competition helps entrepreneurs to understand the strengths and weaknesses of the competition, identify gaps in the market, and develop strategies to gain a competitive advantage. In this chapter, we will discuss the importance of analyzing the competition and the steps involved in the process.

Importance of Analyzing the Competition:

Analyzing the competition is important for several reasons:

- Understanding the Market: Analyzing the competition helps entrepreneurs to understand the market dynamics, such as the demand for services, pricing strategies, and customer preferences.

- Identifying Gaps in the Market: Analyzing the competition helps entrepreneurs to identify gaps in the market that are not being served by the competition. This can help entrepreneurs to develop solutions that cater to the specific needs and preferences of the target market.

- Developing Competitive Strategies: Analyzing the competition helps entrepreneurs to develop strategies that can help them gain a competitive advantage. By understanding the strengths and weaknesses of the competition, entrepreneurs can develop solutions that differentiate them from the competition and improve customer acquisition.

Steps in Analyzing the Competition:

- Identify Competitors: The first step in analyzing the competition is to identify the competitors in the market. This can be done using various methods, such as internet research, market reports, and customer feedback.

- Analyze Competitor Services: Once the competitors are identified, entrepreneurs need to analyze the services and solutions offered by the competition. This can help entrepreneurs to understand the strengths and weaknesses of the competition and identify gaps in the market.

- Analyze Competitor Pricing: Pricing is a critical component of the money transfer business. Entrepreneurs need to analyze the pricing strategies of the competition to develop effective pricing strategies that cater to the specific needs and preferences of the target market.

- Analyze Competitor Marketing Strategies: Marketing is another critical component of the money transfer business. Entrepreneurs need to analyze the marketing strategies of the competition to develop effective marketing strategies that cater to the specific needs and preferences of the target market.

- Develop Competitive Strategies: Based on the analysis of the competition, entrepreneurs need to develop competitive strategies that differentiate them from the competition. This can involve developing innovative solutions, improving customer experience, and developing targeted marketing strategies.

- Test Competitive Strategies: Once the competitive strategies are developed, entrepreneurs need to test the strategies with the target customers. Testing can help entrepreneurs to gather feedback and make necessary improvements to their strategies.

In summary, analyzing the competition is a critical component of market research for a money transfer business. It helps entrepreneurs to understand the market dynamics, identify gaps in the market, and develop strategies to gain a competitive advantage. By identifying competitors, analyzing services and pricing strategies, analyzing marketing strategies, developing competitive strategies, and testing the strategies, entrepreneurs can perform effective competition analysis and gain a competitive advantage in the market.

Competitor analysis

Competitor analysis is a critical component of analyzing the competition for a money transfer business. Competitor analysis involves gathering information about the strengths and weaknesses of the competition, identifying gaps in the market, and developing strategies to gain a competitive advantage. In this section, we will discuss the importance of competitor analysis and the steps involved in the process.

Importance of Competitor Analysis:

Competitor analysis is important for several reasons:

- Understanding the Market: Competitor analysis helps entrepreneurs to understand the market dynamics, such as the demand for services, pricing strategies, and customer preferences.

- Identifying Gaps in the Market: Competitor analysis helps entrepreneurs to identify gaps in the market that are not being served by the competition. This can help entrepreneurs to develop solutions that cater to the specific needs and preferences of the target market.

- Developing Competitive Strategies: Competitor analysis helps entrepreneurs to develop strategies that can help them gain a competitive advantage. By understanding the strengths and weaknesses of the competition, entrepreneurs can develop solutions that differentiate them from the competition and improve customer acquisition.

Steps in Competitor Analysis:

- Identify Competitors: The first step in competitor analysis is to identify the competitors in the market. This can be done using various methods, such as internet research, market reports, and customer feedback.

- Analyze Competitor Strengths: Once the competitors are identified, entrepreneurs need to analyze the strengths of the competition. This can include analyzing the quality of services, customer experience, and marketing strategies.

- Analyze Competitor Weaknesses: After analyzing the strengths of the competition, entrepreneurs need to analyze the weaknesses of the competition. This can include analyzing the pricing strategies, customer complaints, and gaps in the market that are not being served by the competition.

- Identify Gaps in the Market: Based on the analysis of competitor strengths and weaknesses, entrepreneurs can identify gaps in the market that are not being served by the competition. This can help entrepreneurs to develop solutions that cater to the specific needs and preferences of the target market.

- Develop Competitive Strategies: Based on the analysis of competitor strengths, weaknesses, and gaps in the market, entrepreneurs need to develop competitive strategies that differentiate them from the competition. This can involve developing innovative solutions, improving customer experience, and developing targeted marketing strategies.

- Test Competitive Strategies: Once the competitive strategies are developed, entrepreneurs need to test the strategies with the target customers. Testing can help entrepreneurs to gather feedback and make necessary improvements to their strategies.

In summary, competitor analysis is a critical component of analyzing the competition for a money transfer business. It helps entrepreneurs to understand the market dynamics, identify gaps in the market, and develop strategies to gain a competitive advantage. By identifying competitors, analyzing strengths and weaknesses, identifying gaps in the market, developing competitive strategies, and testing the strategies, entrepreneurs can perform effective competitor analysis and gain a competitive advantage in the market.

SWOT analysis

SWOT analysis is a strategic planning tool that helps entrepreneurs to identify the strengths, weaknesses, opportunities, and threats of their business. SWOT analysis is an acronym for Strengths, Weaknesses, Opportunities, and Threats. In this section, we will discuss the importance of SWOT analysis and the steps involved in the process.

❗ Miro has a great template and an article that explains what SWOT is. You can access it here: SWOT Analysis Template.

Importance of SWOT Analysis:

SWOT analysis is important for several reasons:

- Understanding the Business: SWOT analysis helps entrepreneurs to understand the strengths and weaknesses of their business. This can help entrepreneurs to identify areas for improvement and develop strategies to capitalize on their strengths.

- Identifying Opportunities: SWOT analysis helps entrepreneurs to identify opportunities that they can capitalize on. This can include identifying gaps in the market, developing new products or services, and expanding into new markets.

- Identifying Threats: SWOT analysis helps entrepreneurs to identify threats that can impact their business. This can include changes in regulations, changes in customer preferences, and changes in the competitive landscape.

Steps in SWOT Analysis:

- Identify Strengths: The first step in SWOT analysis is to identify the strengths of the business. This can include analyzing the quality of services, customer experience, and marketing strategies.

- Identify Weaknesses: After analyzing the strengths of the business, entrepreneurs need to identify the weaknesses of the business. This can include analyzing the pricing strategies, customer complaints, and areas for improvement.

- Identify Opportunities: Based on the analysis of strengths and weaknesses, entrepreneurs can identify opportunities that they can capitalize on. This can include identifying gaps in the market, developing new products or services, and expanding into new markets.

- Identify Threats: Based on the analysis of strengths, weaknesses, and opportunities, entrepreneurs need to identify threats that can impact their business. This can include changes in regulations, changes in customer preferences, and changes in the competitive landscape.

- Develop Strategies: Based on the analysis of strengths, weaknesses, opportunities, and threats, entrepreneurs need to develop strategies that capitalize on their strengths, improve their weaknesses, capitalize on opportunities, and mitigate threats.

- Monitor and Review: Once the strategies are developed, entrepreneurs need to monitor and review their implementation. This can help entrepreneurs to make necessary improvements to their strategies and adapt to changes in the market.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Strong brand recognition | High transaction fees | Emerging markets | Increasing regulatory requirements |

| Extensive network of agent locations | Slow transaction times | Growing demand for mobile payments | Intense competition from established players |

| Wide range of payment options | Limited customer support options | Increasing globalization | Technological advancements leading to new competitors |

| Strong financial backing | Poor user experience | Increasing demand for remittance services | Currency fluctuations impacting exchange rates |

| Large market share | Limited geographic coverage | Increasing demand for cross-border payments | Economic instability in key markets |

| Innovative technology solutions | Limited product offerings | Changing consumer preferences | Cybersecurity threats and data breaches |

| Strong regulatory compliance | Poor exchange rates | Diversification into new markets | Changes in government regulations and policies |

| Robust fraud detection and prevention measures | Limited customer education and awareness | Partnerships and collaborations | Economic downturns and recessions |

This SWOT table provides an overview of the strengths, weaknesses, opportunities, and threats faced by the money transfer business world. By analyzing these factors, entrepreneurs can develop strategies to capitalize on their strengths, improve their weaknesses, capitalize on opportunities, and mitigate threats.

In summary, SWOT analysis is a critical component of analyzing the competition and developing a successful money transfer business. It helps entrepreneurs to identify the strengths and weaknesses of their business, identify opportunities, and mitigate threats. By identifying strengths, weaknesses, opportunities, and threats, and developing strategies that capitalize on strengths, improve weaknesses, capitalize on opportunities, and mitigate threats, entrepreneurs can perform effective SWOT analysis and develop a successful money transfer business.

IDENTIFYING THE UNIQUE SELLING PROPOSITION (USP)

The Unique Selling Proposition (USP) is a critical component of developing a successful money transfer business. The USP is the factor that sets a business apart from its competition and makes it unique. In this chapter, we will discuss the importance of identifying the USP and the steps involved in the process.

Importance of Identifying the USP:

Identifying the USP is important for several reasons:

- Differentiation: Identifying the USP helps entrepreneurs to differentiate their business from the competition. This can help to attract customers and increase market share.

- Marketing: The USP is a critical component of marketing a business. It helps entrepreneurs to develop targeted marketing strategies that highlight the unique features and benefits of their business.

- Customer Acquisition: The USP can help entrepreneurs to acquire new customers by attracting customers who are looking for a specific solution or feature that is offered by the business.

Steps in Identifying the USP:

- Analyze the Competition: The first step in identifying the USP is to analyze the competition. This involves identifying the services and solutions offered by the competition and analyzing their strengths and weaknesses.

- Identify Customer Needs: The next step is to identify the needs and preferences of the target market. This can be done by conducting surveys, analyzing customer feedback, and researching market trends.

- Analyze Business Capabilities: After analyzing the competition and identifying customer needs, entrepreneurs need to analyze their own business capabilities. This includes analyzing the quality of services, customer experience, and marketing strategies.

- Identify Unique Features and Benefits: Based on the analysis of the competition, customer needs, and business capabilities, entrepreneurs need to identify unique features and benefits that set their business apart from the competition. This can include offering faster transactions, lower fees, and more convenient locations.

- Develop Marketing Strategies: Once the USP is identified, entrepreneurs need to develop marketing strategies that highlight the unique features and benefits of their business. This can include developing targeted marketing campaigns and using social media to reach the target market.

- Monitor and Review: Once the USP is identified and the marketing strategies are developed, entrepreneurs need to monitor and review the effectiveness of their strategies. This can help entrepreneurs to make necessary improvements and adapt to changes in the market.

In summary, identifying the USP is a critical component of developing a successful money transfer business. It helps entrepreneurs to differentiate their business from the competition, develop targeted marketing strategies, and acquire new customers. By analyzing the competition, identifying customer needs, analyzing business capabilities, identifying unique features and benefits, developing marketing strategies, and monitoring and reviewing the effectiveness of the strategies, entrepreneurs can identify the USP and develop a successful money transfer business.

Here are 10 examples of potential USPs for a money transfer business:

- Faster Transactions: Providing customers with a faster transaction process than competitors.

- Lower Fees: Offering customers lower fees for money transfer services than competitors.

- Wider Network: Having a larger network of agent locations or partner banks than competitors.

- Better Exchange Rates: Offering better exchange rates than competitors.

- Enhanced Security: Providing customers with enhanced security measures such as two-factor authentication and fraud detection.

- 24/7 Customer Support: Offering 24/7 customer support via multiple channels such as phone, email, and chat.

- User-Friendly Interface: Providing a user-friendly interface for customers to easily navigate through the money transfer process.

- Mobile App: Offering a mobile app for customers to transfer money on-the-go.

- Multiple Payment Options: Offering customers multiple payment options such as credit card, bank transfer, and cash.

- Social Responsibility: Donating a portion of profits to a social cause or promoting sustainability in business operations.

Value proposition

The value proposition is a statement that summarizes the unique benefits that a money transfer business offers to its customers. The value proposition communicates what makes the business different and why customers should choose it over competitors. In this section, we will discuss the importance of identifying the value proposition and the steps involved in the process.

Importance of Value Proposition:

The value proposition is important for several reasons:

- Differentiation: The value proposition helps entrepreneurs to differentiate their business from the competition. It communicates what makes the business unique and why customers should choose it over competitors.

- Customer Acquisition: The value proposition can help entrepreneurs to acquire new customers by communicating the unique benefits of their business.

- Marketing: The value proposition is a critical component of marketing a business. It helps entrepreneurs to develop targeted marketing strategies that highlight the unique benefits of their business.

Steps in Identifying the Value Proposition:

- Identify Customer Needs: The first step in identifying the value proposition is to identify the needs and preferences of the target market. This can be done by conducting surveys, analyzing customer feedback, and researching market trends.

- Analyze Business Capabilities: After identifying customer needs, entrepreneurs need to analyze their own business capabilities. This includes analyzing the quality of services, customer experience, and marketing strategies.

- Identify Unique Benefits: Based on the analysis of customer needs and business capabilities, entrepreneurs need to identify unique benefits that their business offers to customers. This can include offering faster transactions, lower fees, and more convenient locations.

- Develop Value Proposition Statement: Based on the analysis of customer needs and unique benefits, entrepreneurs need to develop a value proposition statement that communicates the unique benefits of their business to customers.

Examples of Value Proposition:

Here are some examples of value proposition statements for a money transfer business:

- Faster Transactions: “Transfer money faster than any other provider in the market.”

- Lower Fees: “Save money with our low fees for money transfers.”

- Wider Network: “Send money from anywhere in the world with our extensive network of agent locations.”

- Better Exchange Rates: “Get better exchange rates for your money transfers with our competitive rates.”

- Enhanced Security: “Send money with peace of mind with our enhanced security measures.”

- 24/7 Customer Support: “Get the support you need, when you need it with our 24/7 customer support.”

- User-Friendly Interface: “Easily transfer money with our user-friendly online platform.”

- Mobile App: “Transfer money on-the-go with our convenient mobile app.”

- Multiple Payment Options: “Choose from a variety of payment options to send money easily.”

- Social Responsibility: “Send money with a purpose. A portion of our profits goes towards supporting social causes.”

In summary, the value proposition is a critical component of identifying the unique benefits of a money transfer business. It helps entrepreneurs to differentiate their business from the competition, acquire new customers, and develop targeted marketing strategies. By identifying customer needs, analyzing business capabilities, identifying unique benefits, and developing a value proposition statement that communicates those unique benefits, entrepreneurs can develop a successful money transfer business.

Competitive advantage

Competitive advantage is the advantage that a money transfer business has over its competitors. It is the unique factor that allows a business to outperform its competitors in the market. In this section, we will discuss the importance of identifying competitive advantage and the steps involved in the process.

Importance of Competitive Advantage:

Competitive advantage is important for several reasons:

- Differentiation: Competitive advantage helps entrepreneurs to differentiate their business from the competition. It is the factor that sets the business apart from competitors and attracts customers.

- Profitability: Competitive advantage can lead to increased profitability by allowing a business to charge higher prices or reduce costs.

- Market Share: Competitive advantage can help a business to gain market share by attracting customers away from competitors.

Steps in Identifying Competitive Advantage:

- Analyze the Competition: The first step in identifying competitive advantage is to analyze the competition. This involves identifying the services and solutions offered by the competition and analyzing their strengths and weaknesses.

- Identify Unique Features and Benefits: Based on the analysis of the competition, entrepreneurs need to identify unique features and benefits that set their business apart from the competition. This can include offering faster transactions, lower fees, and more convenient locations.

- Analyze Business Capabilities: After analyzing the competition and identifying unique features and benefits, entrepreneurs need to analyze their own business capabilities. This includes analyzing the quality of services, customer experience, and marketing strategies.

- Develop Competitive Advantage Statement: Based on the analysis of the competition, unique features and benefits, and business capabilities, entrepreneurs need to develop a competitive advantage statement that communicates the unique advantage of their business to customers.

Examples of Competitive Advantage:

Here are some examples of competitive advantage statements for a money transfer business:

- Faster Transactions: “Transfer money faster than any other provider in the market, guaranteed.”

- Lower Fees: “We offer the lowest fees for money transfers, guaranteed.”

- Wider Network: “We have the largest network of agent locations, making it easier to send money from anywhere in the world.”

- Better Exchange Rates: “We offer the best exchange rates in the market, saving you money on every transaction.”

- Enhanced Security: “We use the latest security measures to keep your money safe and secure, giving you peace of mind.”

- 24/7 Customer Support: “Our dedicated customer support team is available 24/7 to assist you with any questions or concerns.”

- User-Friendly Interface: “Our intuitive online platform makes it easy to transfer money in just a few clicks.”

- Mobile App: “Our mobile app allows you to transfer money on-the-go, making it easier and more convenient than ever before.”

- Multiple Payment Options: “We offer a variety of payment options to fit your needs, including credit card, bank transfer, and cash.”

- Social Responsibility: “We donate a portion of our profits to social causes, making your money transfer not just a transaction, but a contribution to a better world.”

In summary, competitive advantage is a critical component of identifying the unique factor that allows a money transfer business to outperform its competitors. It helps entrepreneurs to differentiate their business, increase profitability, and gain market share. By analyzing the competition, identifying unique features and benefits, analyzing business capabilities, and developing a competitive advantage statement that communicates the unique advantage of the business, entrepreneurs can develop a successful money transfer business.

Legal & Regulatory Requirements

In order to start a money transfer business, entrepreneurs must comply with various legal and regulatory requirements. These requirements are in place to ensure that money transfer businesses operate in a safe and secure manner, and that customers’ funds are protected. In this section, we will discuss the legal and regulatory requirements that entrepreneurs must adhere to when starting a money transfer business.

The regulatory landscape for money transfer businesses is complex and varies by country. In general, money transfer businesses are subject to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as consumer protection laws. These regulations require money transfer businesses to implement policies and procedures to identify and prevent money laundering and terrorist financing, as well as to protect the interests of consumers.

In addition to AML, CTF, and consumer protection regulations, money transfer businesses may also be subject to licensing and registration requirements. These requirements vary by jurisdiction, and entrepreneurs must be aware of the specific requirements in the jurisdictions in which they operate. Failure to comply with these requirements can result in fines, penalties, and even the revocation of the business license.

BUSINESS REGISTRATION

One of the most important legal and regulatory requirements for starting a money transfer business is business registration. Business registration is the process of formally establishing a business entity with the government. The specific requirements and procedures for business registration vary by jurisdiction, but there are some general steps that entrepreneurs must follow.

Step 1: Choose a Business Structure

The first step in business registration is choosing a business structure. The most common business structures for money transfer businesses are sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its own advantages and disadvantages in terms of liability, tax implications, and management.

Step 2: Register the Business Name

Once the business structure has been chosen, entrepreneurs must register the business name. The name registration process varies by jurisdiction, but it generally involves checking the availability of the name and then registering it with the appropriate government agency. Entrepreneurs should choose a name that is unique, easy to remember, and relevant to the business.

Step 3: Obtain a Tax Identification Number

All businesses are required to obtain a tax identification number (TIN) from the Internal Revenue Service (IRS). The TIN is used to identify the business for tax purposes, and it is required for opening a bank account and filing tax returns. Entrepreneurs can apply for a TIN online or by mail.

Step 4: Obtain Licenses and Permits

In addition to business registration, entrepreneurs may be required to obtain licenses and permits to operate a money transfer business. The specific licenses and permits required vary by jurisdiction, but they may include a money transmitter license, a business license, and a sales tax permit.

Step 5: Register with Financial Regulators

Money transfer businesses are subject to financial regulations, including anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Entrepreneurs must register with the appropriate financial regulator, which varies by jurisdiction. In the United States, for example, entrepreneurs must register with the Financial Crimes Enforcement Network (FinCEN).

Step 6: Comply with Ongoing Requirements

Once the business is registered, entrepreneurs must comply with ongoing requirements, such as filing annual reports and renewing licenses and permits. They must also maintain compliance with financial regulations, including AML and CTF regulations.

Business registration is a critical step in starting a money transfer business. By choosing the right business structure, registering the business name, obtaining a tax identification number, obtaining licenses and permits, registering with financial regulators, and complying with ongoing requirements, entrepreneurs can establish a legal and compliant money transfer business. It is important to research and understand the specific requirements and procedures for business registration in the jurisdiction where the business will operate.

FUNDS FLOW AND TRANSACTION SET

Flow of Funds (FoF)

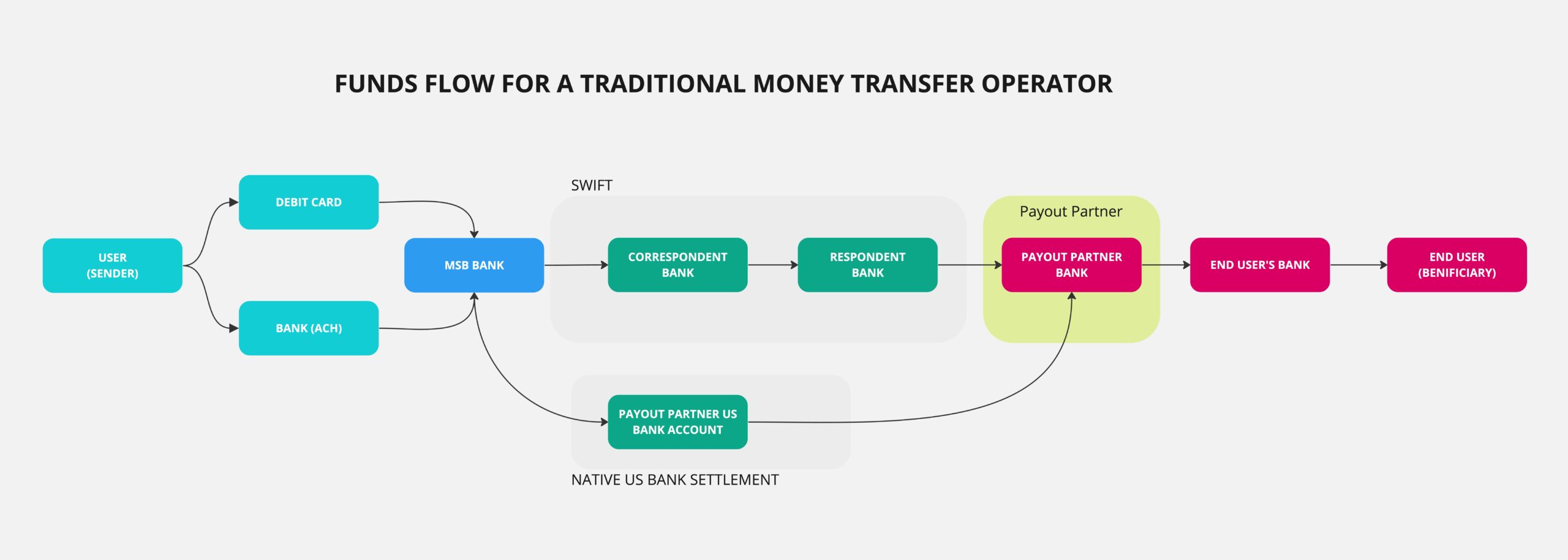

One of the most important aspects of any money transfer operation is the flow of funds. This refers to the process by which money is transferred from the sender to the recipient, including the various steps and parties involved in the transaction. Understanding the flow of funds is crucial for ensuring the security and efficiency of the transfer process.

The flow of funds typically starts with the sender, who initiates the transfer by providing the necessary funds and information to the money transfer operator. The money transfer operator then processes the transaction and transfers the funds to a corresponding agent or bank in the recipient’s country. The recipient can then access the funds either through an agent or directly through their bank account.

One key consideration in the flow of funds is the exchange rate used to convert the funds from one currency to another. Money transfer operators must ensure that the exchange rate is fair and transparent, and that customers understand the fees and charges associated with the transfer. Additionally, operators must comply with relevant regulations and laws governing foreign exchange transactions.

❗ Click here to learn of a simple hack on how to make your own flow of funds diagram. (scroll down to where it says Showcasing Your Flow of Funds)

Another important aspect of the flow of funds is transaction security. Money transfer operators must take appropriate measures to prevent fraud, money laundering, and other forms of financial crime. This may include implementing secure payment processing systems, verifying the identity of customers and agents, and monitoring transactions for suspicious activity.

In addition to traditional money transfer methods, new technologies such as blockchain and cryptocurrency are also transforming the flow of funds. These technologies offer the potential for faster and cheaper transfers, but also present new challenges and risks.

Understanding of Flow of Funds (or Funds Flow) for an MSB (US Edition)

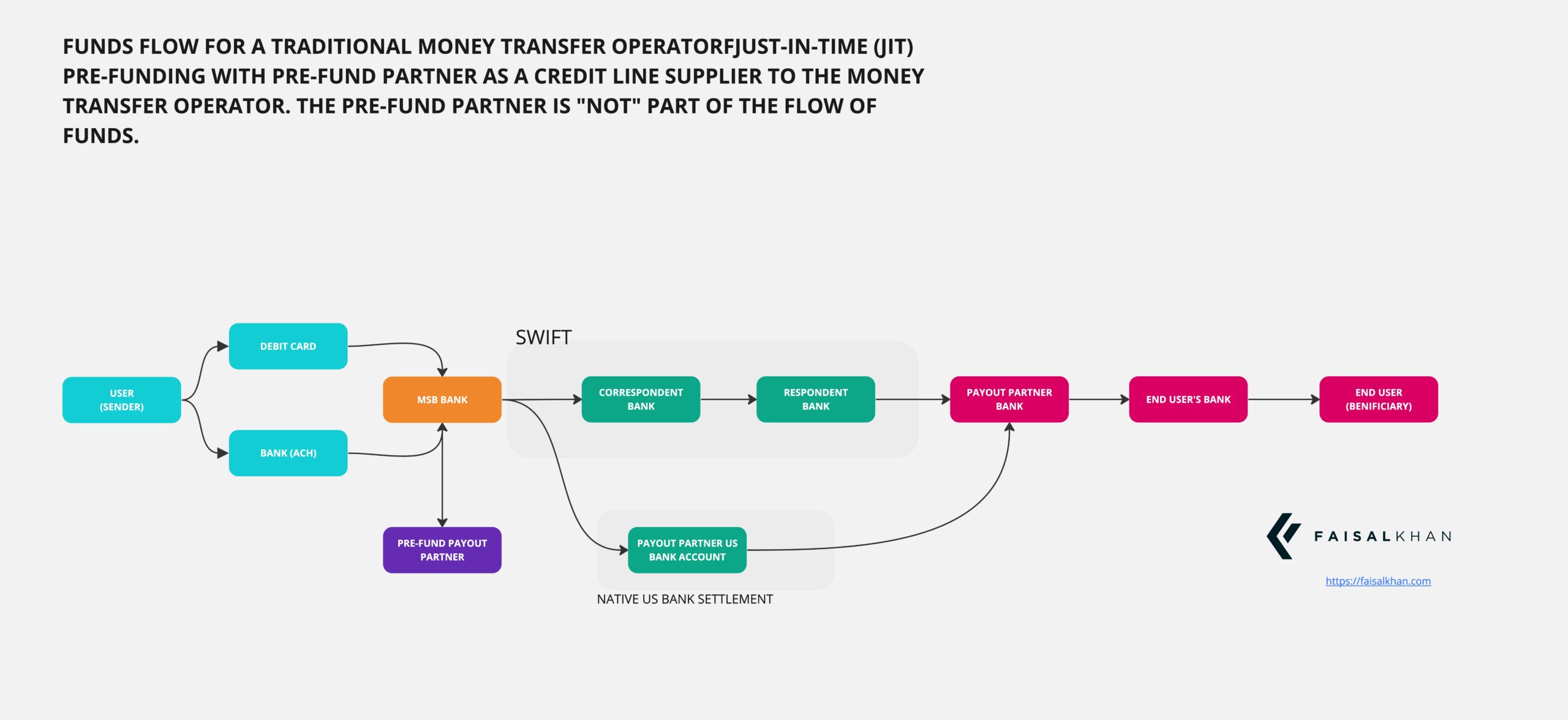

Just-in-Time (JIT) Pre-funding for Money Transfer Operators

Overall, a clear understanding of the flow of funds is essential for any money transfer operator. By carefully managing the transfer process and taking appropriate security measures, operators can ensure the reliability and success of their operations.

This concludes the chapter on the flow of funds, one of the key components of a successful money transfer operation.

Transaction Set

In the money transfer business, a transaction set refers to the various steps and processes involved in completing a money transfer transaction. A transaction set typically includes the following stages:

- Initiation: This is the first step in a transaction set, where the customer initiates a money transfer request. This can be done through various channels, including online portals, mobile apps, or in-person at a physical location.

- Verification: Once the request is received, the money transfer operator verifies the identity of the customer and the authenticity of the transaction. This includes verifying the customer’s personal details, transaction amount, and purpose of the transfer.

- Payment: Once the verification is complete, the customer is asked to provide payment for the transaction. This can be done using various payment methods, such as bank transfer, credit/debit card, or cash payment at a physical location.

- Processing: After the payment is received, the money transfer operator processes the transaction by sending the funds to the recipient. This can involve transferring funds between bank accounts or through third-party payment processors.

- Payout: Finally, the recipient receives the funds and can access them through various payout methods, such as bank transfer, cash pickup, or mobile wallet.

The transaction set is critical to ensuring the smooth and secure transfer of funds from the sender to the recipient. It involves multiple parties, including the sender, the recipient, the money transfer operator, and various financial institutions and payment processors.

To ensure the success of a transaction set, it is important to have robust systems and processes in place to verify identities, process payments, and ensure compliance with regulatory requirements. This may involve integrating with various payment systems and complying with various regulatory requirements, such as anti-money laundering (AML) and Know Your Customer (KYC) regulations.

In summary, a transaction set is a critical component of the money transfer business. It involves multiple stages, including initiation, verification, payment, processing, and payout, and requires robust systems and processes to ensure the smooth and secure transfer of funds.

LICENSES AND PERMITS

In addition to business registration, entrepreneurs starting a money transfer business must obtain the appropriate licenses and permits. The specific licenses and permits required vary by jurisdiction, but there are some general steps that entrepreneurs must follow.

Step 1: Research the Requirements

The first step in obtaining licenses and permits is to research the specific requirements in the jurisdiction where the business will operate. This includes identifying the types of licenses and permits required, as well as the application process, fees, and renewal requirements.

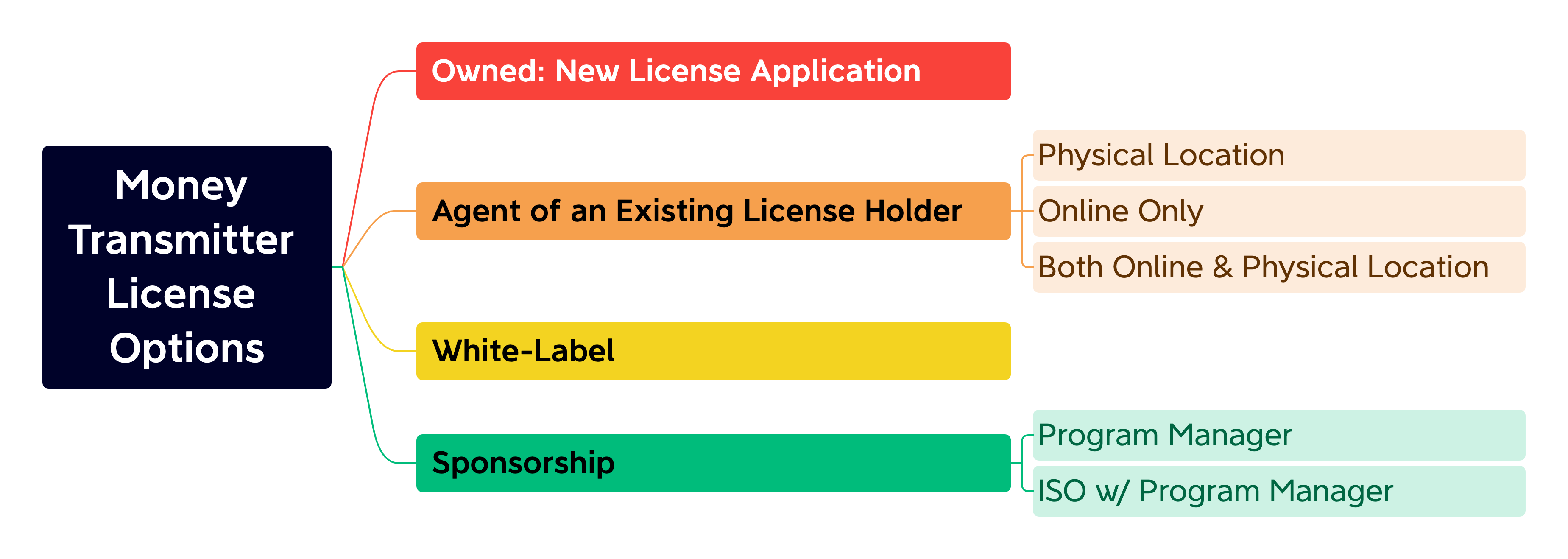

Step 2.1: Apply for a Money Transmitter License

❗ The acquisition of a US Money Transmitter License is mandatory for entities that are categorized as Money Services Businesses operating within the jurisdiction of the United States. This license exclusively pertains to activities conducted within the United States.

One of the most important licenses for money transfer businesses is the money transmitter license. This license is required in most jurisdictions and allows businesses to legally transfer money on behalf of customers. The application process for a money transmitter license varies by jurisdiction, but it generally involves submitting an application, paying a fee, and providing documentation that demonstrates compliance with financial regulations.

❗ For those seeking to familiarize themselves with the US money transmitter licensing regulations, we suggest reviewing three essential guides: (i) United States Money Services Businesses & Money Transmitter License, (ii) The US Money Transmitter License (Summary Table), and (iii) The US Money Transmitter License Cost. These resources have been meticulously crafted to provide comprehensive coverage of the subject matter and serve as valuable tools for gaining a deeper understanding of the regulatory landscape.

Step 2.2: Obtain for a Money Transfer Operator License

If you’re looking to start a money transfer business outside the United States, it’s important to understand that the terminology used for the license can vary from country to country. In some places, a money transfer license may be called a bureau de change or a remittance license, while in other countries it may be referred to as a money services organization license, a money transfer operator license, a plain money transfer license, or a payment institution license. Regardless of what it’s called, obtaining the appropriate license from the regulatory body in the country where you plan to operate is crucial.

❗ Please refer to the list of financial regulators in the appendix section of this document.

In many cases, the requirements for obtaining a money transfer license will be similar across different countries. The regulatory body will typically require the business to meet certain criteria, such as having a certain amount of capital, providing proof of compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, and demonstrating that the business has appropriate risk management procedures in place.

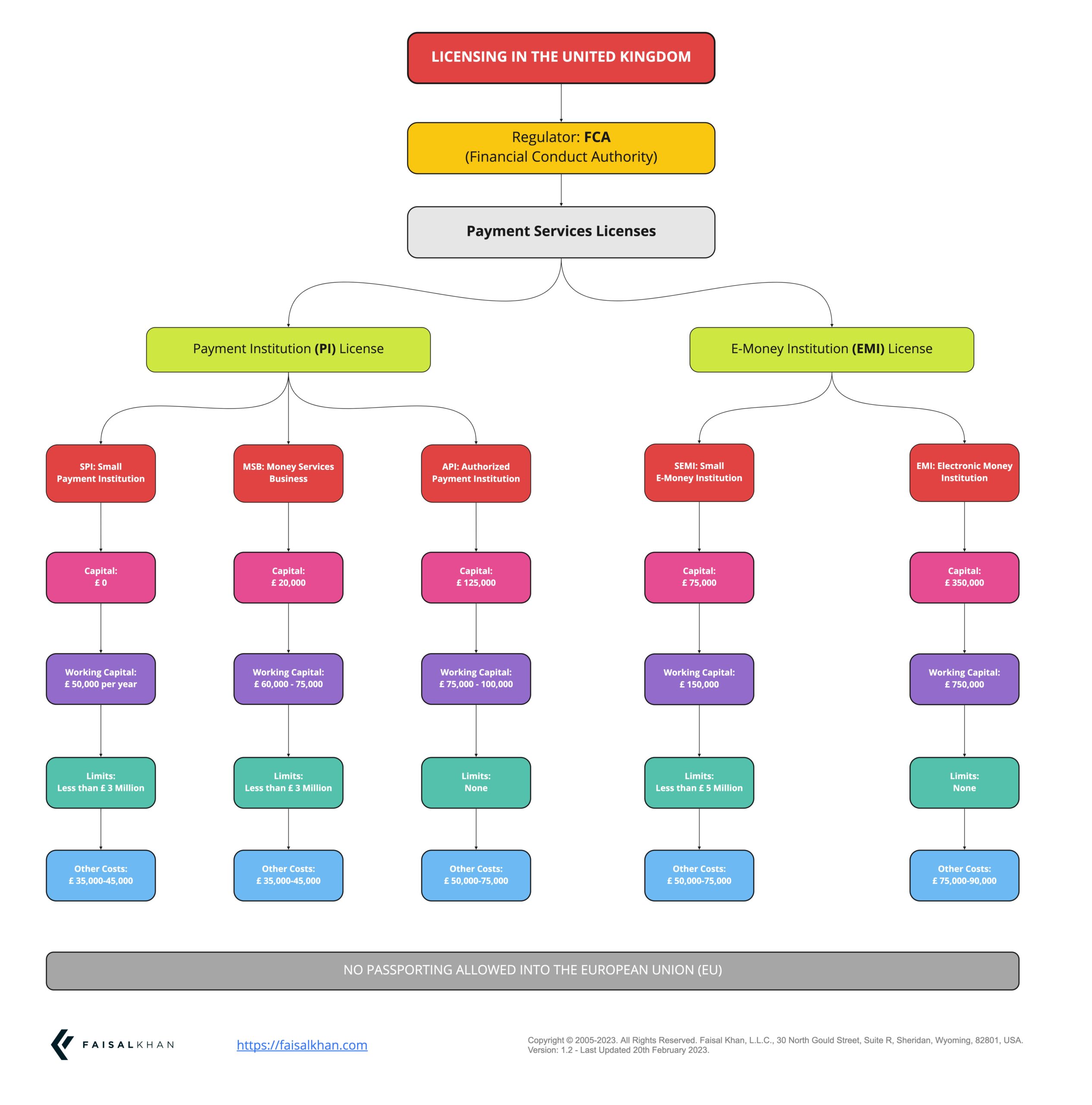

Step 2.2.1: Licensing Example for the UK.

In the United Kingdom, two common types of licenses that are required for companies engaged in financial activities are Payment Institution (PI) and Electronic Money Institution (EMI) licenses. The PI license is needed by companies that engage in payment services, such as money remittance, currency exchange, and bill payments. The EMI license, on the other hand, is required for companies that issue electronic money or prepaid cards.

To obtain these licenses, companies must submit an application to the Financial Conduct Authority (FCA), the regulatory body responsible for issuing these licenses. The application process involves providing detailed information about the company, its business plan, risk management procedures, and financial projections. The FCA will review the application and conduct a thorough assessment of the company’s compliance with relevant regulations and laws before deciding to grant the license.

Overall, obtaining a PI or EMI license in the UK is a rigorous process that requires a comprehensive understanding of the regulations and laws governing the financial services industry. However, obtaining these licenses can provide companies with the necessary credibility and authorization to operate in the UK and expand their customer base.

It’s important to thoroughly research the specific requirements for obtaining a money transfer license in the country where you plan to operate, as there may be additional requirements or regulations that must be followed. Working with a local consultant or attorney who has experience in the industry can be helpful in navigating the licensing process and ensuring compliance with local regulations. Ultimately, obtaining the appropriate license is a crucial step in starting and operating a successful money transfer business in any country.

Step 3: Obtain Other Required Licenses and Permits

In addition to the money transmitter license, entrepreneurs may be required to obtain other licenses and permits, such as a business license, sales tax permit, or money services business license. The specific requirements vary by jurisdiction, and entrepreneurs must research the requirements in their jurisdiction to ensure compliance.

Step 4: Renew Licenses and Permits

Once the licenses and permits are obtained, entrepreneurs must ensure that they are renewed in a timely manner. This may involve submitting annual reports, paying renewal fees, and demonstrating ongoing compliance with regulations.

Step 5: Maintain Compliance with Regulations

Maintaining compliance with regulations is critical for money transfer businesses. This includes compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as consumer protection laws. Entrepreneurs must implement policies and procedures to identify and prevent money laundering and terrorist financing, as well as to protect the interests of consumers.

Failure to obtain the appropriate licenses and permits, or to maintain compliance with regulations, can result in fines, penalties, and even the revocation of the business license. It is important for entrepreneurs to understand and comply with all legal and regulatory requirements.

In summary, obtaining the appropriate licenses and permits is a critical step in starting a money transfer business. Entrepreneurs must research the specific requirements in their jurisdiction, apply for the necessary licenses and permits, renew them in a timely manner, and maintain compliance with regulations. By doing so, entrepreneurs can establish a legal and compliant money transfer business that meets the needs of customers and contributes to financial inclusion.

ANTI-MONEY LAUNDERING (AML) AND KNOW YOUR CUSTOMER (KYC) COMPLIANCE

Money transfer businesses are subject to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as consumer protection laws. These regulations require money transfer businesses to implement policies and procedures to identify and prevent money laundering and terrorist financing, as well as to protect the interests of consumers. In this chapter, we will discuss AML and Know Your Customer (KYC) compliance for money transfer businesses.

AML Compliance

Anti-money laundering (AML) compliance involves implementing policies and procedures to identify and prevent money laundering and terrorist financing. This includes performing due diligence on customers, monitoring transactions, and reporting suspicious activity.

Step 1: Perform Customer Due Diligence

One of the most important aspects of AML compliance is performing customer due diligence (CDD). CDD involves identifying and verifying the identity of customers, as well as assessing their risk for money laundering and terrorist financing. This may involve collecting information such as name, address, date of birth, and government-issued identification.

Step 2: Monitor Transactions

Once customers have been identified and verified, money transfer businesses must monitor their transactions for suspicious activity. This may involve setting transaction limits, monitoring unusual transaction patterns, and reviewing large or complex transactions.

Step 3: Report Suspicious Activity

If suspicious activity is identified, money transfer businesses must report it to the appropriate authorities. In the United States, this involves filing a suspicious activity report (SAR) with the Financial Crimes Enforcement Network (FinCEN).

KYC Compliance

Know Your Customer (KYC) compliance involves implementing policies and procedures to ensure that customers are who they say they are and that they are using the money transfer service for legitimate purposes.

Step 1: Collect Customer Information

To comply with KYC regulations, money transfer businesses must collect information about their customers. This may include name, address, date of birth, occupation, and purpose of the transaction.

Step 2: Verify Customer Information

Once customer information has been collected, money transfer businesses must verify that the information is accurate. This may involve comparing the information provided by the customer to government-issued identification or other reliable sources.

Step 3: Assess Risk

Money transfer businesses must assess the risk posed by each customer and transaction. This may involve considering factors such as the amount of the transaction, the location of the customer, and the purpose of the transaction.

Step 4: Implement Controls

Based on the risk assessment, money transfer businesses must implement controls to prevent and detect money laundering and terrorist financing. This may involve setting transaction limits, monitoring transactions, and reporting suspicious activity.

Maintaining Compliance

Maintaining compliance with AML and KYC regulations is critical for money transfer businesses. Failure to comply with these regulations can result in fines, penalties, and even the revocation of the business license. It is important for entrepreneurs to stay up-to-date with the latest AML and KYC regulations and to implement policies and procedures to ensure compliance.

In summary, AML and KYC compliance are critical components of starting and operating a money transfer business. Entrepreneurs must implement policies and procedures to identify and prevent money laundering and terrorist financing, as well as to protect the interests of consumers. By doing so, entrepreneurs can establish a legal and compliant money transfer business that meets the needs of customers and contributes to financial inclusion.

Customer Due Diligence

Customer due diligence (CDD) is a critical component of AML and KYC compliance for money transfer businesses. CDD involves identifying and verifying the identity of customers, as well as assessing their risk for money laundering and terrorist financing. This sub-chapter will discuss the importance of CDD and provide examples and references to major institutes or companies.

Importance of CDD

CDD is important for several reasons. First, it helps money transfer businesses comply with AML and KYC regulations, which are designed to prevent money laundering and terrorist financing. Second, it helps businesses identify and mitigate risks associated with their customers and transactions. Finally, it helps businesses build trust and credibility with their customers.

Types of CDD

There are three types of CDD: Simplified Due Diligence (SDD), Basic Due Diligence (BDD), and Enhanced Due Diligence (EDD).

- Simplified Due Diligence (SDD) is used for low-risk customers, such as those who are established customers, have a low transaction volume, or are located in a low-risk jurisdiction. SDD requires minimal customer identification and verification, but money transfer businesses must still monitor transactions for suspicious activity.

- Basic Due Diligence (BDD) is used for moderate-risk customers, such as those who are new customers, have a higher transaction volume, or are located in a higher-risk jurisdiction. BDD requires more extensive customer identification and verification, as well as monitoring of transactions for suspicious activity.

- Enhanced Due Diligence (EDD) is used for high-risk customers, such as those who have a history of suspicious activity, are politically exposed, or are located in a high-risk jurisdiction. EDD requires extensive customer identification and verification, as well as ongoing monitoring of transactions and source of funds.

Examples and References

Examples of major institutes or companies that provide guidance on CDD include:

- Financial Action Task Force (FATF): The FATF is an intergovernmental organization that sets international standards for AML and CTF. The FATF provides guidance on CDD and other AML/KYC requirements.

- Office of Foreign Assets Control (OFAC): The OFAC is a division of the U.S. Department of the Treasury that administers and enforces economic sanctions against targeted foreign countries, individuals, groups, and entities. The OFAC provides guidance on CDD and sanctions compliance.

- Western Union: Western Union is a major money transfer company that has implemented extensive AML/KYC policies and procedures, including CDD. Western Union uses a risk-based approach to CDD, with SDD for low-risk customers, BDD for moderate-risk customers, and EDD for high-risk customers.

- MoneyGram: MoneyGram is another major money transfer company that has implemented AML/KYC policies and procedures, including CDD. MoneyGram uses a risk-based approach to CDD, with SDD for low-risk customers, BDD for moderate-risk customers, and EDD for high-risk customers.