Unlock the Secrets of Running a Successful Money Transfer Business: Read our Comprehensive Guide Now!

This article provides a comprehensive guide to starting and running a successful money transfer business, covering key areas such as licensing, compliance, technology, partner selection, marketing, and risk management. It offers valuable insights, tips, and practical examples for entrepreneurs and business owners looking to enter the money transfer industry or improve their existing operations. With a focus on innovation, customer experience, and regulatory compliance, this article is a must-read for anyone interested in launching a successful money transfer business in today’s competitive market.

Introduction

Entering the remittance industry is not particularly difficult as long as you have a basic understanding of how businesses operate. However, it is crucial to keep in mind that the transfer of money is a regulated activity that requires compliance with the law.

Failure to obtain the necessary licenses and follow the appropriate regulations can result in significant consequences, including fines and imprisonment.

Therefore, you should consult with local regulatory bodies and attorneys specializing in this field before proceeding with any plans to enter the remittance industry.

Diving Into The Money Transfer Business

It is common for individuals to enter the remittance industry without adequately researching and understanding the field. They may spend a few hours reading about it or even try transferring money themselves, but this is insufficient to become an industry expert. In fact, becoming knowledgeable and successful in the remittance industry requires significant time and dedication. Without a deep understanding of the industry and a commitment to the business, competing with others and making a profit can be challenging.

Additionally, it is important to be aware that the remittance industry is often viewed as a low-hanging fruit, which can lead to intense competition. This can make it difficult to survive in the business, as there are likely to be many other individuals and companies vying for a share of the market.

Dip Your Toes Into the Water

Before you find out the hard way, it is always better to start small. Everyone wants to be able to do this…

However, the rider you see on that bike most likely started with the vehicle below and worked their way up…

Yes. Training Wheels! Put them on!

It is advisable to start small and proceed with caution when entering the remittance industry, as investing too much money and time too quickly can lead to significant losses. Starting small allows you to make mistakes and learn from them, which is an important aspect of the process.

Additionally, it is important to pay attention to the industry’s subtle nuances, as these can ultimately determine your success.

For example, suppose you are planning to set up a physical location for your remittance business. In that case, it may be wise to start with a small location in a less competitive area before expanding to a larger, more competitive location. By starting small and carefully, you can gain valuable experience and knowledge that will help you succeed in the long run.

- Establishing partnerships with other companies or individuals: This can involve negotiating terms, setting up contracts, and finding mutually beneficial arrangements.

- Seeking help and advice from relevant sources: This could include consulting with legal professionals, regulatory bodies, industry experts, or other individuals with experience in the remittance industry.

- Working with vendors and suppliers: This may involve identifying reliable and cost-effective sources for necessary goods and services, negotiating terms, and building relationships with these companies.

- Maximizing the use of your working capital: This could involve finding ways to reduce expenses, increase efficiency, or generate additional income in order to maximize the use of your available financial resources.

- Marketing your business and targeting specific client groups: This may involve creating marketing materials, identifying potential customers, and developing strategies to reach and attract these individuals.

- Testing different approaches and measuring their effectiveness: A/B testing involves comparing two or more versions of something (such as a marketing message or website design) in order to determine which is most effective.

- Understanding and complying with relevant regulations: This may involve obtaining necessary licenses and permits, following industry standards and guidelines, and staying up-to-date on any changes to the regulatory environment.

- Knowing your competition and their strategies: This may involve researching other companies in the industry, analyzing their offerings and marketing techniques, and developing ways to differentiate your business from theirs.

- Paying attention to the specific characteristics and trends of different remittance corridors: This could involve analyzing data on exchange rates, fees, and other factors that can impact the cost and feasibility of transferring money in different regions.

- Building relationships with banks and other financial institutions: This may involve negotiating terms, complying with their requirements, and finding ways to make your business an attractive partner for these organizations.

- Carefully calculating the costs associated with transferring money: This could involve analyzing expenses such as fees, exchange rates, and other charges that can impact the overall cost of a transaction.

- Increasing the volume of money transferred: This may involve finding new customers, expanding to new regions, or offering additional services in order to grow your business.

- Effectively managing Know Your Customer (KYC) processes: This could involve developing and implementing procedures to verify the identity of your customers and ensure compliance with relevant regulations.

- Avoiding involvement in money laundering or terrorist financing: This may involve implementing policies and procedures to prevent your business from being used to funnel illicit funds.

- Building a strong and effective team: This could involve recruiting and hiring skilled and dedicated employees, training and developing their skills, and creating a positive and supportive work environment.

Remember, there is no shame in starting small. It pays in the long run to start small and grow.

It All Starts With Licensing

In most countries and territories, operating a money transfer business requires a license. Therefore, it is advisable to research and understand the licensing process before proceeding with any plans to enter the industry.

This may involve consulting with regulatory bodies and attorneys, obtaining the necessary permits and approvals, and fulfilling any other requirements set forth by the authorities.

By taking the time to properly address the licensing issue from the outset, you can avoid potential legal issues and set your business up for success.

In order of difficulty (from lowest to highest):

- Affiliate

- Correspondent

- Correspondent / ISO

- Authorized Delegate

- Licensed

- Banking Agent

A more detailed explanation of the route you can take with respect to licensing is explained here: US Money Transmitter License

Licensing Alternatives

One option to consider when entering the remittance industry is becoming an affiliate. There are several advantages to this approach, including:

- Minimal financial investment: As an affiliate, you typically do not need to invest a significant amount of money upfront, making it a relatively low-risk option.

- Rapid learning: Working as an affiliate allows you to gain hands-on experience and quickly become familiar with industry terminology and processes.

- Comprehensive understanding: While you may not learn about every aspect of the industry as an affiliate, you will still gain a thorough understanding of how money transfer works and the various factors involved.

- Practical experience: Rather than simply learning about the industry theoretically, becoming an affiliate allows you to gain firsthand experience and see the practical applications of what you have learned.

- Testing the waters: By becoming an affiliate, you can gauge the difficulty of acquiring and retaining clients, which can be valuable information as you consider expanding your business.

- Flexibility: If things do not work out as an affiliate, you can walk away without incurring significant losses or being tied to long-term contracts. You can also enroll with another money transfer operator as an affiliate if you wish to continue exploring the industry.

- Free education: The MTOs you work with may provide additional training and support to help you better understand the industry and succeed as an affiliate.

Once you feel confident in your understanding of the remittance industry and your own risk tolerance, you may be ready to move on to the next level of involvement. This could involve transitioning from a training wheels approach, such as becoming an affiliate, to a more advanced level of involvement such as becoming an authorized delegate or agent.

Alternatively, if you have already gained significant knowledge and experience in the industry through internships or work with an MTO, you may be ready to pursue your own licenses and establish your own business.

Ultimately, the appropriate level of involvement will depend on your understanding of the business and your comfort with the associated risks.

Players in the Ecosystem

The next thing is to understand the different players in the money transfer business that make up the ecosystem:

The image below depicts more or less a complete model of all the players that will ever be:

- Sender: The individual who is sending the remittance.

- Sender’s Bank: The bank that the sender will use to fund the remittance transaction. This can also be funded in cash at an agent location or by using other payment instruments such as credit/debit cards or mobile credits.

- Beneficiary: The person who will be receiving the remittance money.

- Beneficiary’s Bank: The bank where the remittance money is credited. Alternative methods include mobile wallets (which also involve a bank on the back end) or cash-over-counter (COC), in which case the beneficiary can receive cash upon presenting proper identification at an agent location or bank.

- Money Transfer Operator (Sending Side): The licensed entity in the sending country that is legally responsible for facilitating the remittance.

- Money Transfer Operator Bank (Sending Side): The financial institution(s) that the MTO in the sending country uses to aggregate the funds and distribute them.

- Money Transfer Operator/Bank (Receiving Side): The counterparty in the receiving country, which may be a licensed MTO or a bank.

- Correspondent Bank (Sending Side): A correspondent bank may be involved in hosting the sending bank/MTO’s Nostro account or in channeling funds between the sending MTO and the receiving MTO/bank.

- Payment Processor: A payment processor may be used if payment instruments such as ACH, debit/credit cards, or other platforms like PayPal or Dwolla are being utilized. The payment processor is contracted by the money transfer operator (sending side).

- ID Verification (KYC): A third party service may be used to authenticate and verify the IDs submitted as part of the onboarding process by the sending MTO.

- Agent/Affiliate: An agent or affiliate may be used on the sending side to onboard the transaction and on the receiving side to offload the remittance transaction.

- Payment Network: MTOs may use various payment networks to route the remittance transfer, such as a third-party network like Earthport to settle transactions in countries where the MTO is not directly integrated.

Diving Into The Business

Before entering the money transfer industry, it is advisable to consider taking two steps to gain a better understanding of the field:

- Attend a money transfer conference: There are several conferences that focus on the money transfer industry, such as the CrossTech, formerly known as International Money Transfer Conference (IMTC) and the International Association of Money Transfer Networks (IAMTN). Attending one of these conferences can provide valuable insights and networking opportunities.

- Find a mentor: Having a mentor in this field can be extremely beneficial, as they can provide guidance and support as you navigate the industry. It may be helpful to reach out to professionals with experience in the money transfer industry to see if they are willing to mentor you.

Working Capital

Regardless of your approach to entering the money transfer industry, it is important to have access to working capital. If you are considering the affiliate route, you may need financial resources to invest in marketing efforts such as creating landing pages, writing blog articles, and utilizing search engine optimization, search engine marketing, and social media marketing.

On the other hand, if you are pursuing the correspondent route, you may be required to provide pre-funding to the sending MTO. This means you will be responsible for providing the necessary financial resources to cover the cost of the transaction before it is completed. It is important to carefully consider your financial needs and plan accordingly when entering the money transfer industry.

If you’re going the Authorized Delegate route, then you can read up the following articles to better understand:

- Access to US Money Transfer Market

- Should you own a Money Transmitter License?

- FAQs on ISO/Correspondent Relationship

- Correspondent vs. Authorized Delegate

For trying to obtain your own licensing, you can check the amount of money needed from each financial regulator, by visiting their website. The complete list can be found here: List of Money Transmitter License Regulators

Access to Banking

This could be a very difficult proposition for you. Finding a bank (read: MSB Friendly Banks), willing to work with an MSB engaged in the cross-border money transfer business is not easy.

Because of Operation Chokepoint, there is a lot of De-Risking of MSBs going on in the banks.

You can read more about this in these 3-series articles that I wrote:

- The Sandstorm that is blanketing the Money Services Business

- Can’t find MSB Friendly Banks?

- Banking De-Risking: The Domino Effect Is Now In Full Force.

Most MTOs will not provide you with access to banking (unless you’re 100% purely affiliate). If you are going to come on-board as an ISO/Correspondent, Authorized Delegate, etc. you bring your own banking relationship to the equation.

Anti-Money Laundering Training

One of the reasons that MTOs and banks may be hesitant to work with small businesses and individuals is due to a lack of knowledge about anti-money laundering (AML) and Know Your Customer (KYC) regulations. It is crucial for everyone in the money transfer industry to undergo AML training, and this includes affiliates.

To gain a thorough understanding of the industry and the associated terminology, it is advisable to invest time in obtaining advanced training. These trainings can be completed online and may take anywhere from one week to several weeks to complete.

Before beginning advanced training, it may be beneficial to read extensively about AML and KYC regulations. There are numerous books and manuals available online that can provide a solid foundation of knowledge in these areas. Additionally, there is a wealth of free educational material available on YouTube and other online platforms that can help explain key concepts.

Compliance Officer

In addition to being an affiliate, most other programs or associations in the money transfer industry will require you to have a full-time compliance officer on staff at your organization. It is important to ensure that your compliance officer is fully qualified and has undergone comprehensive training in areas such as anti-money laundering (AML), Know Your Customer (KYC), and Customer Identification Procedures (CIP). A certification such as the Certified Anti-Money Laundering Specialist (CAMS) may be preferred.

While it may be tempting to try to save money in this area, it is important to invest in a highly qualified and competent compliance officer. A solid compliance officer can provide credibility and stability for your business, and can be well worth the investment in the long run.

Compliance Program

An effective and constantly improving compliance program is essential for any reputable money transfer company. It is not uncommon for a significant portion of a company’s human resources, such as 5-10%, to be dedicated to running the compliance program.

To ensure the success of your compliance program, it is advisable to work with a high-quality compliance specialty company to develop and implement the program. These companies have expertise in the subtle elements that can impact a compliance program, and can help ensure that your program is tailored to the specific legal corridors and transaction/financial models under which your business operates.

While it may be tempting to try to cut costs in this area, it is important to invest in a top-quality compliance program. Skimping on this aspect of your business can have serious consequences and is not worth the risk.

Choosing Your Corridor

One important step in entering the money transfer industry is identifying the markets in which you want to operate. Depending on your arrangement, you may already have an established bank or MTO to work with, or you may need to find one and establish a partnership with your principal license holder in the sending country.

Establishing partnerships, or “tie-ups,” can be a tedious process involving a significant amount of paperwork and time. However, these partnerships are essential for operating in both markets and should not be overlooked. It is important to carefully consider your market strategy and ensure that you have the necessary partnerships in place to succeed.

Software & Allied Services

If your arrangement does not include software and related services such as ID verification, OFAC checks, and sanctions list checks, it is important to make arrangements for these resources. It is advisable to begin this process as early as possible, as it can take some time to implement.

The goal is to have a system that can handle both front-office and back-office functions, and that can provide audit logs for auditors. A list of transaction data points that may be required for an MSB audit can be found here: List of Transaction Data Points for an MSB Audit (Note: this is just an example).

There are various options available for obtaining software for your money transfer business, such as purchasing, leasing, renting, or using a software as a service (SaaS) model with original equipment manufacturers (OEMs). A list of OEMs that offer software for the money transfer industry can be found using Google or talking to peers in the industry who might be able to recommend something for you. It is important to carefully consider your options and choose the solution that best fits the needs of your business.

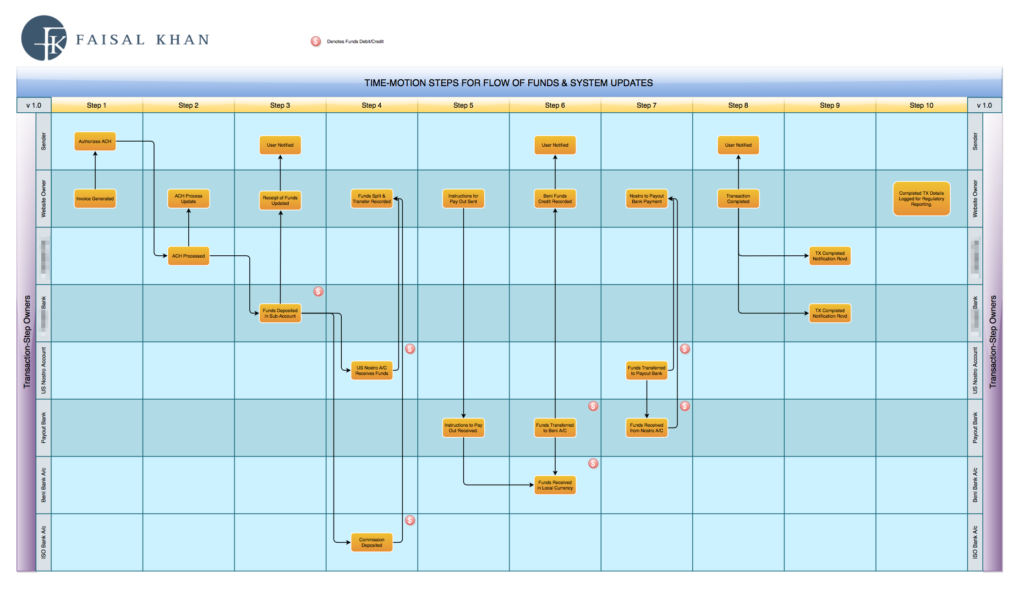

Put a Plan Together

It is crucial to have a clear understanding of your transaction set and the flow of funds in your business. This includes being aware of the potential profits and ensuring that every penny is accounted for. It is important to have a detailed understanding of how the process works and how much money is being deducted at each step, as well as who is responsible for keeping this money. This knowledge will help you to run a profitable and transparent business.

A sample flow can look like this:

Some Essential Homework

Before starting your business, it is important to take care of the following tasks:

- Choose a name for your business. This may or may not be the same as your brand name, but it is necessary to have a legal name for your company.

- Decide where to incorporate your business. Consider factors such as location, tax laws, and the overall business environment.

- Choose a brand name for your remittance product, even if you are initially going the ISO/Affiliate route.

- Purchase a domain name for both your business and brand name.

- Obtain Google Apps to have a professional email address for your company.

- Get a dedicated phone number for your business.

- Create social media profiles on platforms such as Facebook, Twitter, LinkedIn, TikTok, Pinterest, Quora, and Instagram.

- Build a professional website with the help of a design and development team. Consider using a customizable WordPress theme.

- Hire a professional writer or firm to create content for your website.

- Have a professional design a logo for your business.

- Set up a mailing list using a service like MailChimp, and create a “Launching Soon” landing page.

- Conduct market research by interviewing potential customers and gathering data on their needs and preferences, as well as the current state of the market.

- Determine your target market and the cities you will initially focus on for marketing.

- Estimate the cost of marketing efforts.

- Consult with local regulators and specialized attorneys to ensure compliance with relevant laws and regulations.

- Determine the best way to access banking services, considering factors such as fees, account requirements, and potential hurdles.

- Calculate the costs associated with transferring money, including fees for banking services, currency exchange, and other expenses.

- Develop a plan for growth, including strategies for increasing volume and improving control over know-your-customer (KYC) processes.

- Consider the risks and benefits of partnering with vendors and suppliers, and determine the most suitable arrangement for your business.

- Evaluate the competition and identify opportunities to differentiate your business in the market.

- Determine the best way to leverage your working capital, considering factors such as investment opportunities, marketing efforts, and potential risks.

- Implement marketing and focus your efforts on acquiring clients. Consider using techniques such as A/B testing to determine the most effective strategies.

- Build a team of skilled and reliable professionals to support the growth and success of your business.

- Stay up-to-date on industry trends and developments, and continually seek out opportunities to improve and evolve your business model.

Research and Data are extremely important for you to proceed ahead. Go out into the real world and interview potential customers. Take notes.

- What facilities are desired by potential customers?

- What are the pain points of potential customers when using current services?

- Who do potential customers currently use for money transfer services?

- Why would potential customers choose your service over others?

- What is the average amount of money being transferred by potential customers?

- How long does it typically take for money to arrive at its destination for potential customers?

- What improvements can be made to the customer experience?

- What is the exchange rate typically experienced by potential customers?

- What aspects of current money transfer services are disliked by potential customers?

- What aspects of current money transfer services are liked by potential customers?

- If you were to offer a service today, would potential customers switch from their current provider?

- How many existing players are in the market? Is it overcrowded?

- What sets your service apart from others in the market?

- In which cities would you initially focus your marketing efforts?

- How much would it cost to effectively market your service in these cities?

Business Plan

It is important to create a business plan, as it helps to give structure to your ideas and approach. It can also be a helpful tool to refer to in order to stay on track and make informed decisions. There are many templates available online to guide you in writing a business plan. Remember to make time to develop this important document and consult it regularly as you work on your new venture.

Here are some tips to consider when creating your business plan:

- Determine your goals and objectives. What are you trying to achieve with your money transfer business?

- Understand your target market. Who are you targeting as your customers?

- Research your competition. What other money transfer businesses exist and how do they compare to your business?

- Outline your marketing strategy. How will you reach and attract customers?

- Develop a financial plan. How much money do you need to start and run your business, and how will you generate revenue?

- Set milestones and create a timeline. What are the key steps you need to take to achieve your goals and how long do you expect them to take?

Having a well-written business plan will give you a clear roadmap to follow and help you stay organized and focused as you start and grow your business.

Wishing you the best of luck on your project.

—

This page was last updated on April 12, 2023.

–