Africa, the continent represents over 54 countries and territories. A very large swatch of the world’s freelancers live in Africa and whilst they may have access to markets in the Western World (think Europe, UK, Canada, United States), access to banking in these markets is very restricted.

One such country from where we receive a lot of requests is Nigeria. Entrepreneurs all the time are asking us if there is a way, users in Nigeria can get somehow a bank account number in the United States (even if it is virtual) and then the funds that get deposited into this account, are somehow transported across using Bitcoin?

Based on our understanding of your unique setup, you will get an account from Synapse, that would allow you to issue FBO account numbers under your omnibus account.

This would essentially place the responsibility on your omnibus account, whilst allowing a freelancer, from around the world to receive payment (presumably from a business to start with – as Payoneer does), into their US virtual bank account (for receiving only).

This balance is then with you, and at some point in time, a user may wish to get this balance back to them in say Kano, Nigeria.

In this instance, the simplest position (albeit, wrong and I will explain why) would be to go to Coinbase (or any other liquidity provider) and buy bitcoins and then push these coins to their designated Luno account, from where they can cash out or do whatever they want with it.

You could have an excellent arbitrage play here as well, but I presuming the pressure would be to obtain BTC or USDT in USD as the base quote. Although as a provider you can say, the payment would only be delivered in NGN (and herein lies the opportunity for you to play not only the BTC arbitrage game but also on the FX gain).

Whilst this is fine, there are a few issues and also areas for improvement.

Needless to say, you would need a US money transmitter license. Hence, you cannot take custody of funds, until and unless you possess a money transmitter license. I believe with the virtue of getting an omnibus account, you would also have to register with FinCEN?

Anyhow, you would need to have some form of a money transmitter license (here it needs to be debated if you need nationwide or just a single state?) – will come back to that.

Once you have a money transmitter license (or are sponsored by an entity that has one), you simply cannot just ask that entity to buy bitcoins with it and send them across to the user’s end wallet. Cross border payments do not work like this.

Other than banks, which are the only exempt institutions, every other NBFI (non-banking financial institution) would require a correspondent tie-up agreement with the payout party, i.e. in this case, if Luno is the payout party, then Luno needs to be licensed in the country they are in, and they would sign-up a correspondent tie-up agreement with the originating institution to be able to let the cross border transaction happen.

Luno, being an unlicensed BTC/Exchange in the region (sans clear regulatory policy), no US institution that is classified as a Money Services Business and has various Money Transmitter Licenses will allow you to have such an arrangement. The ambiguity of the payout country partner is a huge No-No, not worth it to risk their license.

Also, your entire plan hinges on correspondent arrangements with each payout country partner, i.e. with each exchange in each territory.

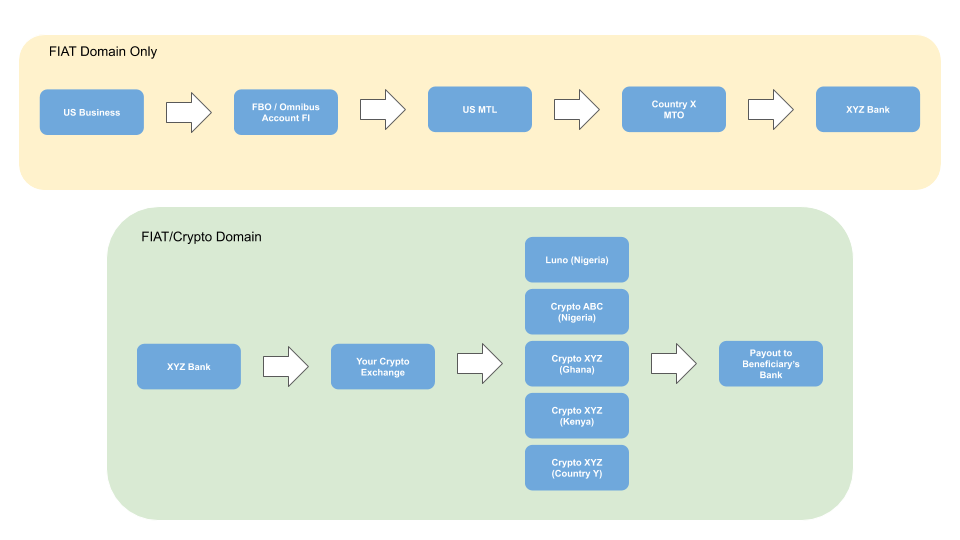

Here is what we would propose as an alternative:

- Tie-up with a US Money Transmitter License that would handle fiat only. No need to convert the balance into crypto. Why? you ask! It is because the US MTL holder (or as we would like to call it – PLH – Principal License Holder) would most likely lose their access to banking if their bank found out that the PLH was engaged in any crypto activity (even if the crypto activity was with a ‘different’ bank). Relationship with the US MTL/PLH – should in Fiat only.

- The second part of the equation is to have this money somehow transferred to another license holder (outside the US). This could be in Europe. This could be in Papa New Guinea. This could be anywhere outside the US (a non-sanctioned country of course), which would be a licensed entity and would have a single correspondent tie-up with the US MTL holder.

- In the final part, you then get access to a white-label legal crypto exchange of your own (for all your customers). In a legal jurisdiction that allows you to have direct control of the digital assets, and have access to your customer’s data for future enhanced products. A legal crypto exchange that can take Fiat balance (on the whole) and assign the crypto balance as per the balance holding of each customer.

It also allows you to then not have to deal with the issue of multiple correspondent contracts with other exchanges and entities. Your users would be free to take their say USDT or other Crypto balance to the exchange of their choice and cash out.

Alternatively, you could also partner up with various entities in the payout countries to offer that service yourself. I’ve attached a diagram to this effect below.

We are able to offer all this if you are interested. Single window (end-to-end).

If you’re interested in this, please use the contact form and get in touch with us.

—

This page was last updated on January 16, 2023.

–