Virtual IBANs: The Future of Global Transactions

In today’s fast-paced global economy, businesses need efficient and secure payment solutions to keep up with the competition. Virtual IBANs are a revolutionary technology that offers a unique way to simplify your financial transactions, making your business more efficient and cost-effective.

Virtual IBANs are a new concept in the financial world that offers a virtual bank account number to businesses, allowing them to receive payments and make payments without the need for a physical bank account. This innovative solution is rapidly gaining popularity due to its ability to simplify international transactions and streamline the payment process.

In this article, we’ll explore the world of Virtual IBANs, including their benefits, how they work, and why IBAN virtual accounts are becoming an essential tool for businesses worldwide.

- Virtual IBANs: The Future of Global Transactions

- What are Virtual IBANs and How Do They Work?

- Why Your Business Needs Virtual IBANs

- Virtual IBANs vs. Traditional Bank Accounts:

- Who Can Benefit from IBAN Virtual Accounts?

- How Virtual IBANs Can Help Your Business Grow

- Frequently Asked Questions About Virtual IBANS:

What are Virtual IBANs and How Do They Work?

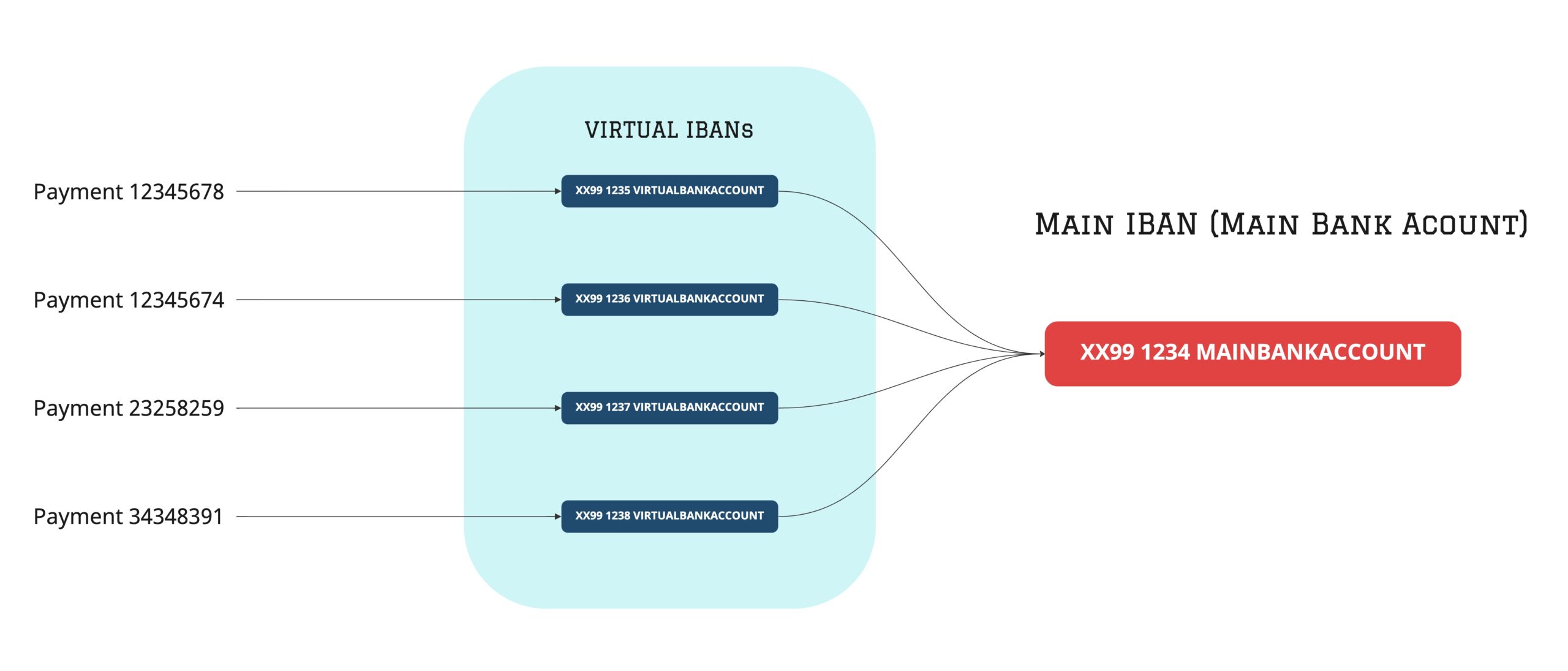

Virtual IBANs work similarly to traditional bank accounts, but with a few key differences. When you sign up for a Virtual IBAN, you’ll receive a unique IBAN number that’s connected to a virtual account. This account operates as a sub-account under a larger, physical bank account.

When you receive payments into your IBAN virtual accounts, the funds are automatically transferred to your physical account. You can then use these funds to make payments or transfer them to another bank account.

The main advantage of Virtual IBANs is that they eliminate the need for a physical bank account in each country where you do business. This can simplify the payment process and save you time and money.

Why Your Business Needs Virtual IBANs

Simplify International Transactions

One of the biggest advantages of IBAN virtual accounts is that they simplify international transactions. When you have a physical bank account in each country where you do business, you need to manage multiple accounts, each with its own fees and transaction limits. With Virtual IBANs, you can manage all your international transactions from a single account.

Streamline Payment Processes

Virtual IBANs can also streamline your payment processes. With a traditional bank account, you need to manually reconcile each payment, which can be time-consuming and error-prone. With Virtual IBANs, payments are automatically reconciled, reducing the risk of errors and saving you time.

Reduce Costs:

Virtual IBANs can also reduce costs by eliminating the need for physical bank accounts in each country where you do business. This can save you money on account setup fees, maintenance fees, and transaction fees.

Virtual IBANs vs. Traditional Bank Accounts:

Security:

Virtual IBANs offer enhanced security compared to traditional bank accounts. Since your IBAN virtual account is connected to a physical bank account, your funds are protected by the same security measures as a traditional account. Additionally, Virtual IBANs offer added security features, such as two-factor authentication and encryption, to protect your account from fraud and cyberattacks.

Flexibility:

Virtual IBANs offer greater flexibility than traditional bank accounts. With a Virtual IBAN, you can receive and make payments in multiple currencies, which can help you reduce the costs associated with currency conversion. Additionally, Virtual IBANs can be set up quickly and easily, allowing you to start receiving payments almost immediately. This can be especially beneficial for small businesses or startups that need to establish a payment system quickly.

Start Managing Your Cross-Border Payments With Ease!

With personalized IBANs, multi-currency support, and a variety of payment options, our platform is the perfect solution for businesses of all sizes.

Who Can Benefit from IBAN Virtual Accounts?

Virtual IBANs are a versatile financial solution that can benefit a wide range of businesses. Here are some examples of businesses that can benefit from using Virtual IBANs:

Small Businesses and Startups:

For small businesses and startups, Virtual IBANs can provide an efficient and cost-effective solution for managing their finances. With Virtual IBANs, businesses can easily receive and send payments in different currencies, without the need for multiple bank accounts. This saves time and money, making it easier for small businesses and startups to focus on growth and expansion.

Multinational Corporations:

Large multinational corporations that operate in multiple countries can also benefit from using Virtual IBANs. With the ability to generate IBANs in various currencies, businesses can manage their finances more efficiently and reduce the risks associated with currency fluctuations. Additionally, these online multicurrency accounts provide enhanced security features, making them a secure option for large corporations dealing with large amounts of money.

E-commerce Businesses:

Online businesses that sell products and services globally can benefit from Virtual IBANs as they offer a simple and secure way to receive payments from customers around the world. With IBAN virtual accounts, e-commerce businesses can easily manage their finances and streamline payment processes, allowing them to focus on growing their business.

Freelancers and Consultants:

Freelancers and consultants who work with clients from different countries are always in need of a secure way to pay and accept international payments. With Virtual IBANs, freelancers and consultants can easily receive payments in different currencies, without the need for multiple bank accounts. This saves time and reduces costs, making it easier for them to manage their finances and focus on their work.

Affiliate Programs:

Affiliate programs need a secure and efficient way to process affiliate payments. With Virtual IBANs, affiliate programs can easily generate IBANs in various currencies, making it easier to receive and send payments to affiliates around the world. This simplifies payment processes and reduces the likelihood of errors, ensuring that affiliates are paid accurately and on time. Additionally, these accounts offer enhanced security features, protecting against fraud and cyberattacks, making them a secure option for affiliate programs.

Fintech Companies:

Fintech companies can benefit from virtual accounts as they provide a flexible and cost-effective solution for managing payments and processing transactions. Fintech companies can easily generate international bank numbers in different currencies, simplifying payment processes and reducing the need for multiple bank accounts. Additionally, these accounts offer enhanced security features, protecting against fraud and cyberattacks, making them a secure option for fintech companies dealing with large amounts of money.

Importers and Exporters:

When doing business across borders, traditional banking systems often present challenges such as high fees, long processing times, and currency conversion fees. With Virtual IBANs, importers and exporters can easily receive and send payments in different currencies, without the need for multiple bank accounts or intermediaries.

These online accounts also come with enhanced security features, making them a safe and secure option for businesses that deal with large amounts of money. Additionally, they provide greater transparency and visibility into transactions, allowing businesses to easily track and reconcile payments.

Marketplace Businesses:

With these online multicurrency accounts, marketplace businesses can easily manage their finances and streamline payment processes, reducing the need for manual processing and decreasing the likelihood of errors.

Virtual IBANs can also help marketplace businesses expand globally by allowing them to easily receive and send payments in different currencies, without the need for multiple bank accounts or intermediaries. This can help marketplace businesses attract more international buyers and sellers, leading to increased revenue and growth.

PSPs and MTOs:

PSPs and MTOs can use these accounts to offer their customers a secure and efficient way to send and receive payments globally.

These accounts help PSPs and MTOs reduce the costs associated with traditional banking systems, such as high fees and long processing times. Additionally, a virtual IBAN account can help these businesses expand their services by offering their customers the ability to receive and send payments in different currencies.

How Virtual IBANs Can Help Your Business Grow

Online multicurrency accounts like these are quickly becoming an essential tool for businesses worldwide. With their ability to simplify international transactions, streamline payment processes, and reduce costs, they offer a unique solution to the challenges of global business.

As the world becomes more interconnected, Virtual IBANs are poised to revolutionize the way we do business, making it easier and more efficient than ever before. Whether you’re a small business owner or a multinational corporation, these accounts can help you streamline your financial transactions and take your business to the next level. So why wait? Start exploring the world of IBAN virtual accounts today and see how they can benefit your business.

Start Managing Your Cross-Border Payments With Ease!

With personalized IBANs, multi-currency support, and a variety of payment options, our platform is the perfect solution for businesses of all sizes.

Frequently Asked Questions About Virtual IBANS:

Virtual IBANs can be obtained through a variety of providers, including banks, financial institutions, and fintech companies. To get a Virtual IBAN, you will need to provide information about your business and the purpose of the Virtual IBAN. Some providers may also require additional documentation or information.

Yes, Virtual IBANs can be used for international transactions. They allow businesses to easily receive and send payments in different currencies, making them a convenient solution for businesses that operate internationally.

Over 30 major currencies are supported, including USD, EUR, GBP, CHF, AUD, CAD, JPY, CNY, HKD, SGD, NZD, SEK, NOK, DKK, ZAR, AED, SAR, and more. Please note that this information is subject to change and it is recommended to confirm the list of supported currencies with us directly when you start working with us.

—

This page was last updated on June 15, 2023.

–