US Money Transmitter License 101

Options available with respect to the US Money Transmitter License

This page is NOT optimized for viewing on a mobile device.

This document aims to provide you with a tl;dr (too long, didn’t read) version of all things US Money Transmitter Licensing.

There are quite a few options available for obtaining a money transmitter license for your business needs in the United States. The US licensing regime is complicated, so we have tried to make it simple for you to understand your options.

The United States does not have a single money transmitter license. One has to obtain a money transmitter license from each US state. So effectively, there are 49 money transmitter licenses (the exception being the State of Montana, which does not have a money transmitter license). The federal territory of Washington D.C. and the three US territories, namely: Puerto Rico, the US Virgin Islands, and Guam.

Detailed information regarding licensing for US Cryptocurrency Regulations will be published on this page soon.

See the complete list of US State Regulators here:

On a federal level, there is registration required with FinCEN, but do note that FinCEN registration is not a license. You can learn more about this in a clarification video I did here and here.

Please be acutely aware that there is no federal-level money transmitter licensing offering (other than getting a financial charter of a bank).

Summary Table for US States Money Transmitter License with Cost Breakdown

This is a detailed breakdown of the costs involved in filing for a new application with the State Regulator.

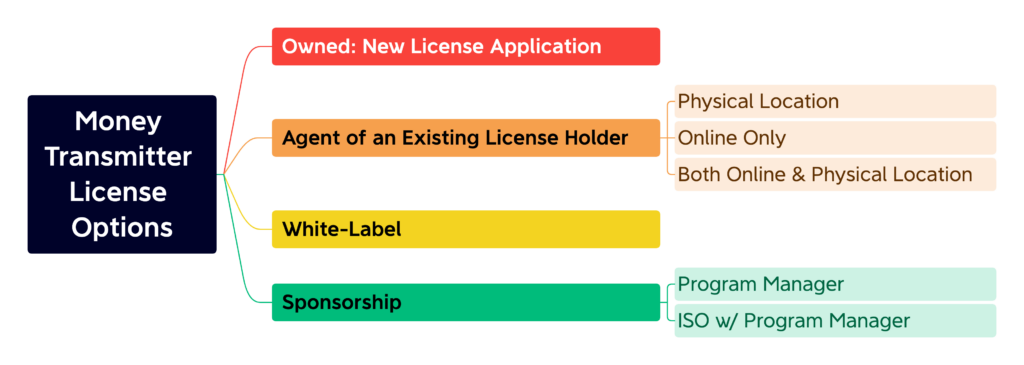

So what are your options?

There are four ways to get regulatory coverage for US Money Transmitter License if your business has been defined as a Money Services Business.

To summarize them, they are listed below. Our company offers all four options as part of our service offering:

- Apply for your own money transmitter license with each state regulator,

- Become an Agent of an existing money transmitter license holder,

- Find a sponsoring institution that can provide you with the necessary regulatory cover for your money transmitter license needs (essentially, you’re Renting a License, also called a Sponsored License), and lastly,

- Enroll in a White-Label Program with an entity with a money transmitter license of their own.

The table below provides a glimpse into the differences between the programs.

US Money Transmitter License (MTL) Summary Table

| Questions | New License Application | Authorized Agent / Delegate. | Sponsorship | White-Label |

|---|---|---|---|---|

| How long does it take to get this licensing arrangement? | Takes up to two years*. | Takes about 4-5 business days for approval. EDD can take up to two weeks. See the suggested timeline for MTL Agent/Sponsorship. Please read the Advisory: Guidance on Domain Naming for Authorized Agents Operating Under US Money Transmitter Licenses in Online Businesses. | Takes about two weeks. See the suggested timeline for MTL Agent/Sponsorship. Please be acutely aware of the Advisory Notice on Sponsorship vs. Authorized Agent. | Takes about two weeks. |

| By what other name(s) is this program known as? [they may not always be correct] | MSB License, Money Services Business License, Money Transmitter License, Money Transmission License, MTL, MTL License, USA FinCEN License, USA MSB License, MSB Licensing, Business Money Transmitter License. | Authorized Delegate, Registered Agent, MSB Agent, MTL Agent, Money Services Business Agent, Money Transmitter License Agent, Money Transmission Agent, MSB Delegate, Agent of MSB. | Operator Led Model, Sponsored License, Program Manager, Bank Sponsor, MSB Sponsor, MTL Sponsor, Bank-led Sponsorship, Non-Custodial Sponsorship, License Sponsorship, Banking as a Service, BaaS, Platform as a Service, PaaS, Payment as a Service, Remittance as a Service, RaaS, Money Transfer as a Service, MTaaS, Rent-a-License. | White-label Sponsorship, Non-Custodial Sponsorship, White Label Solution Provisioning, White Label Provider. |

| Is Due Diligence required? – Enhanced Due Diligence – Customer Due Diligence | Due Diligence will be part of the license application process. | Due Diligence might take up to three weeks, depending on how ready you are with your documentation. A list of the required documents can be seen here. | Due Diligence might take up to three weeks, depending on how ready you are with your documentation. | Due Diligence might take up to three weeks, depending on how ready you are with your documentation. |

| How much does it cost? | Costs between US$ 2.0 to 2.5 Million to obtain all the licenses. | Varies, but starts at US$ 10,000 (one-time fees) to US$ 30,000 (one-time fees) | Varies, but starts at US$ 10,000 (one-time fees) to US$ 30,000 (one-time fees) | Varies, but starts at US$ 10,000 (one-time fees) to US$ 15,000 (one-time fees) |

| Can we have access or custody of funds (value)? | You will have access/custody of funds. | You will have access/custody of funds. | You will not have access to client funds. | You will not have access to client funds. |

| Is a Compliance Officer required? | You need a dedicated MLRO / CCO** | You need a dedicated MLRO / CCO** | You do not need a dedicated MLRO / CCO. | You do not need a dedicated MLRO / CCO. |

| Payment Processing Services | You can have your own card and payment processor. | You can have your own card and payment processor. | You cannot have your own card and payment processor. | You cannot have your own card and payment processor. |

| Is access to banking provided? | Access to banking is something you will have to arrange. | Access to banking is something you will have to arrange or could be provided for by the PLH*** | Access to banking for customer funds would be provided. Banking for the cleared funds would be the responsibility of your counterpart or correspondent. | Access to banking for customer funds would be provided. Banking for the cleared funds would be the responsibility of your counterpart or correspondent. |

| Is the use of Crypto allowed? | You can use crypto if licensed and approved by the regulator and your financial institution (i.e., the bank). | You can use crypto if the PLH and its financial institutions are approved for its usage. | You can use crypto if the PLH and its financial institutions provide it as part of their service offering. | You can use crypto if the PLH and its financial institutions provide it as part of their service offering. |

| Can we take custody of crypto in our own wallet? | You can take crypto custody in your wallet only if licensed and approved by the regulator and financial institutions, respectively. | You can take crypto custody in your wallet only if the PLH is licensed and approved by the regulator and financial institutions. | Unless you are licensed for the same, you cannot take custody of crypto in your wallet. | Unless you are licensed for the same, you cannot take custody of crypto in your wallet. |

| AML and related Compliance responsibilities | Anti-Money Laundering is your responsibility. | Anti-Money Laundering is your responsibility. | Anti-Money Laundering is not your responsibility. | Anti-Money Laundering is not your responsibility. |

| Is a Compliance Manual required? | Yes. | Yes. | No, but preferred. | No. |

| Is an understanding of Compliance Basics required? | Yes | Yes | Yes | No, but preferred. |

| Do all the employees need to have Anti-Money Laundering Awareness Training? | Yes | Yes | No, but preferred to have Anti-Money Laundering Awareness Training. | No, but preferred to have Anti-Money Laundering Awareness Training. |

| Bespoke Products or Services? | You can offer any product &/or service for which you are allowed to roll out as per your Business Plan submitted to the regulator. | You can offer any product &/or service for which you are allowed to roll out as per your discussion and approval by the PLH. | You can only offer products &/or services as being provided by the Sponsor. You cannot add or edit that offering. | You can only offer products &/or services as being provided by the Sponsor. You cannot add or edit that offering. |

| Can we assign Agents? | Yes. | No. | No. | No. |

| Technology Stack | You have to provide the entire technology stack. | You will have to bring the technology stack that will integrate with the APIs / Technology stack offered by your PLH. | You must bring the technology stack that will integrate with the APIs / Technology stack your license sponsor offers. | You do not have to bring in any sort of technology stack. The white-label provider offers everything. |

| Federal Registration: Financial Crimes Enforcement Network (FinCEN) | Register with FinCEN | Register with FinCEN | Register with FinCEN (if requested by the Sponsoring License Holder). | Do not have to register with FinCEN. |

| Do we require a presence in the United States? | US presence is required. | US presence is required. | US presence is not required. | US presence is not required. |

| Can we deal in cash? | Can deal in Cash if part of the original service offering in the application. | Can deal with cash if allowed by PLH. | Can deal with cash if allowed by PLH. Usually, under scarce circumstances, this is permitted. | You are not allowed to deal in cash. |

| What is the minimum net worth required? | A minimum of $1 Million in net worth is required. | A minimum of US$ 100,000 in net worth is required. | Will have to demonstrate financials of US$ 100,000 or more. | Will have to demonstrate financials of US$ 75,000 or more. |

| Is a Surety Bond required? | Surety Bond is required. | Surety Bond is required. If the transaction volume increases significantly, the sponsoring PLH will be asked by the state regulator to up their bonding. The difference in cost may be passed on to you. | Surety Bond is not required; however, if the transaction volume increases significantly, the sponsoring PLH will be asked by the state regulator to up their bonding. The difference in cost may be passed on to you. | Surety Bond is not required. |

| Is an Audit required? | Yes. For part of your application process, you will have to provide audited financials and audits of your security and systems. | Yes. For part of your application process for becoming an Agent, you will have to provide audited financials and audits of your security and systems. Your Sponsoring License Holder will predominantly do this audit. | No. You may be subject to review by your Sponsoring License Holder. | Not Applicable. |

| How difficult (or complicated) is the approval process? | Very Difficult. Expect to be patient and fully committed to human and capital resources. Expect to answer many questions or clarifications as sought by the state examiner. | Difficult. You will have to go through enhanced due diligence, review of your compliance program and associated funds flow, etc. but comparatively much more accessible than a new license application. | Relatively easy. Enhanced due diligence is required. | Relatively easy. Enhanced due diligence is required. |

| Do we have to share revenue with anyone else? | There is no revenue share. All the revenue is for your to keep. Depending on the US State, you have to give a very small amount to them based on the volume and value of the transactions processed for that state. | Revenue share applicable. | Revenue share applicable. | Revenue share applicable. Typically, you are offered wholesale pricing. |

| How can I search for an institution that is a Solution Provider? | For Money Transmitter License, you can check the NMLS (Nationwide Multistate Licensing System). For Banks, you can check the FFIEC – NIC (Federal Financial Institutions Examination Council) – (National Information Center) You can also check the FDIC BankFind Suite (Federal Deposit Insurance Corporation) | For Money Transmitter License, you can check the NMLS (Nationwide Multistate Licensing System). For Banks, you can check the FFIEC – NIC (Federal Financial Institutions Examination Council) – (National Information Center) You can also check the FDIC BankFind Suite (Federal Deposit Insurance Corporation) | For Money Transmitter License, you can check the NMLS (Nationwide Multistate Licensing System). For Banks, you can check the FFIEC – NIC (Federal Financial Institutions Examination Council) – (National Information Center) You can also check the FDIC BankFind Suite (Federal Deposit Insurance Corporation) | For Money Transmitter License, you can check the NMLS (Nationwide Multistate Licensing System). For Banks, you can check the FFIEC – NIC (Federal Financial Institutions Examination Council) – (National Information Center) You can also check the FDIC BankFind Suite (Federal Deposit Insurance Corporation) |

| On whose name is the license? | The license is in your name. | License is in the name of the PLH, you can show that you are an Agent of the PLH. | The license is in the name of the PLH. Your legal and fine print will announce the same. You will essentially be a technology and marketing provider. | The license is in the name of the PLH. Your legal and fine print will announce the same. You will essentially be a marketing provider. |

| Is the product launched under our name or some other name? | Launch the product in your name. | License is in the name of the PLH, you can show that you are an Agent of the PLH. | Launch the product under your own name, but it must have a reference to the original PLH. | Launch the product under your own name, but it must have a reference to the original PLH. |

| Can we migrate customers to our license as and when we get them? | N/A | Yes. Once you get your own licenses, you can migrate your sales/transactions from the Agent License Agreement to your own License without any additional work. | Yes. Once you get your licenses, you can migrate your sales/transactions from the Sponsor License Agreement to your own License without additional work. | Yes. Once you get your licenses, you can migrate your sales/transactions from the Whitelabel License Agreement to your own License with additional work. |

| What would be the name reflected on the customer transaction receipts? | Yours. The legal name of the entity that has the license. | The name of the PLH and possibly yours to indicate you as an authorized agent of the PLH. | The name of the PLH. | The name of the PLH. |

| How much money (one-time) are we looking at? | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. |

| What sort of monthly recurring costs are we talking about? | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. |

| What would your commission be? | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. | Please have a look at our pricing page for more information. |

| Is success guaranteed? | No. Depends on various factors such as your Business Plan, Net Worth, Due Diligence, Background Check, Source of Funds, Qualification Criteria, etc. | No. Depends on various factors such as your Business Plan, Net Worth, Due Diligence, Background Check, Source of Funds, Qualification Criteria, etc. | No. Depends on various factors such as your Business Plan, Net Worth, Due Diligence, Background Check, Source of Funds, Qualification Criteria, etc. | No. Depends on various factors such as your Business Plan, Net Worth, Due Diligence, Background Check, Source of Funds, Qualification Criteria, etc. |

| From where can I get detailed information on each state and the documentation required: | AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT (does not have an MTL – however Read the Advisory), NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. Washington D.C., Puerto Rico, US Virgin Islands | AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT (does not have an MTL – however Read the Advisory), NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY. Washington D.C., Puerto Rico, US Virgin Islands | Not Applicable in this category. | Not Applicable in this category. |

| What about a money-back guarantee? | There is no money-back guarantee with respect to our application fees or professional services. | We guarantee a successful approval. If you do not sign up with the PLH, then any advance referral fee you might have paid will be refunded in full, minus the one-time application fee (which is non-refundable). | We guarantee a successful approval. If you do not sign up with the PLH, then any advance referral fee you might have paid will be refunded in full, minus the one-time application fee (which is non-refundable). | We guarantee a successful approval. If you do not sign up with the PLH, then any advance referral fee you might have paid will be refunded in full, minus the one-time application fee (which is non-refundable). |

** Money Laundering Reporting Officer / Chief Compliance Officer

*** Principal License Holder, the entity that holds the money transmitter licenses in its name.

The information provided on this website is for general informational purposes only and does not constitute legal advice. The information is not intended to be a substitute for legal advice from a qualified attorney. The accuracy of the information provided on this website cannot be guaranteed and should not be relied upon as such. This website and its owners will not be held liable for any inaccuracies or errors in the information provided. Please consult a qualified attorney for legal advice.

—

This page was last updated on December 3, 2023.

–