Public Advisory for Money Transfer Licensing in the UK

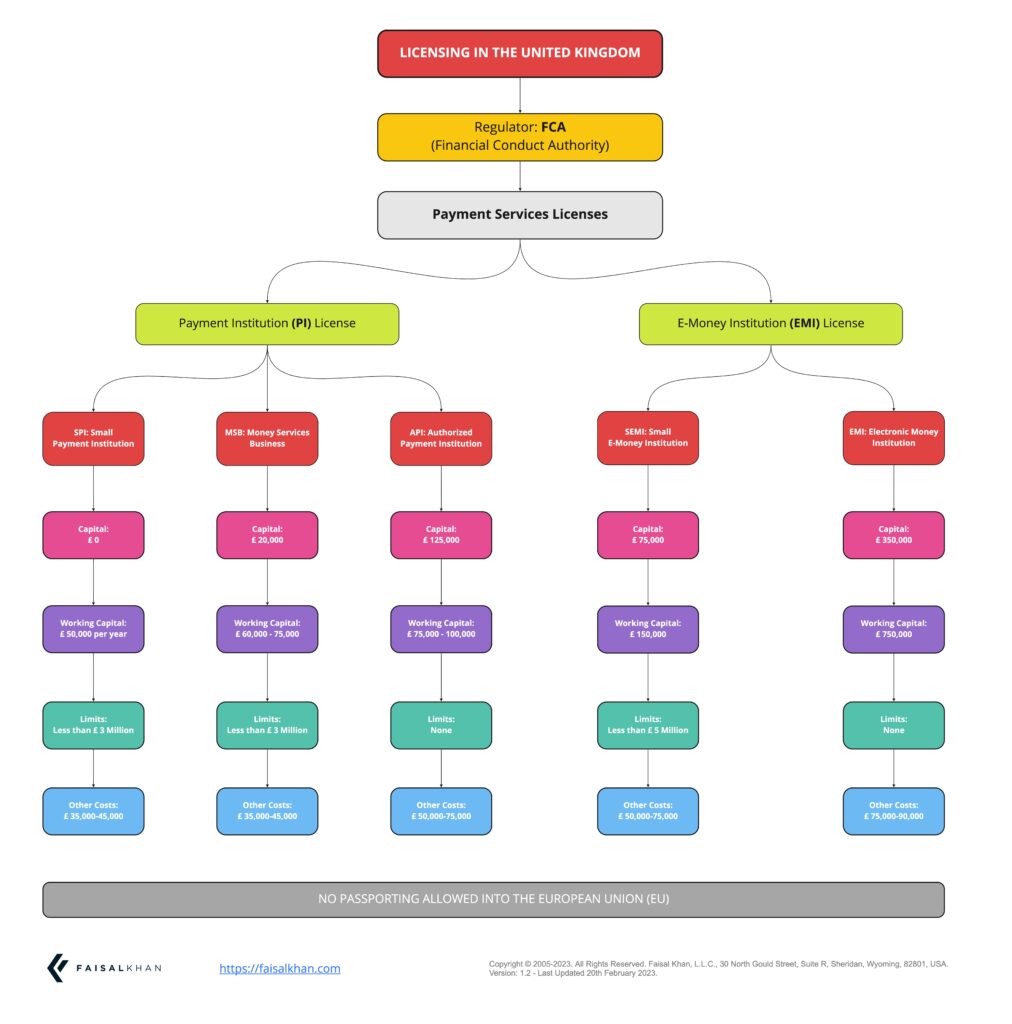

The Financial Conduct Authority (FCA) in the UK has implemented a stringent and restrictive approach to licensing, resulting in significant delays and a sharp decrease in approval rates. Entrepreneurs seeking licenses must carefully consider the challenges and requirements before proceeding. Read more here.

API license is a step up from SPI license, allowing your business more transactional and regional freedom.

Before applying for this license, your business must first qualify the list of conditions set forth by FCA. The application process for an API license is a far more thorough and stringent process, as it is scrutinized meticulously not just by FCA, but also by Payment Services Regulations 2017 (PSRs), Electronic Money Regulations (EMRs) and HMRC.

API licensed firms are required to maintain an initial capital of a minimum of 20,000 EUR to 125,000 EUR, depending upon the nature of services being offered.

Download this as a PDF: Licensing in the UK by FCA for SPI API and EMI

Under this license, your business can provide for a full range of payment services as described by PSRs 2017 under Schedule 1 Part 1

Some notable advantages of an API license over SPI are :

- Conduct EEA and cross border transactions

- Passporting

- Conduct account information or payment initiation services

- No transaction size limit / Unlimited transactions

We Can Help

Here’s how we can help you obtain an API license in the UK:

- API UK Licensing Process

- Applying for a New API License in the UK

- Fee Details for API License UK

- Main Requirements for API License UK

- Scope of Legal Services for API License UK

- Timeframe & Additional Services for API License UK

—

This page was last updated on June 1, 2023.

–